New report shows just how much Canadians are struggling financially

Money, and lack thereof, is causing sleepless nights and straining personal relationships for many Canadians spread out across three generations.

According to the RBC Canadian Financial Wellbeing Survey – Fall 2023 Edition, Generations X, Y (millennials), and Z admit that money is taking a toll on their mental health and they’re living paycheque to paycheque.

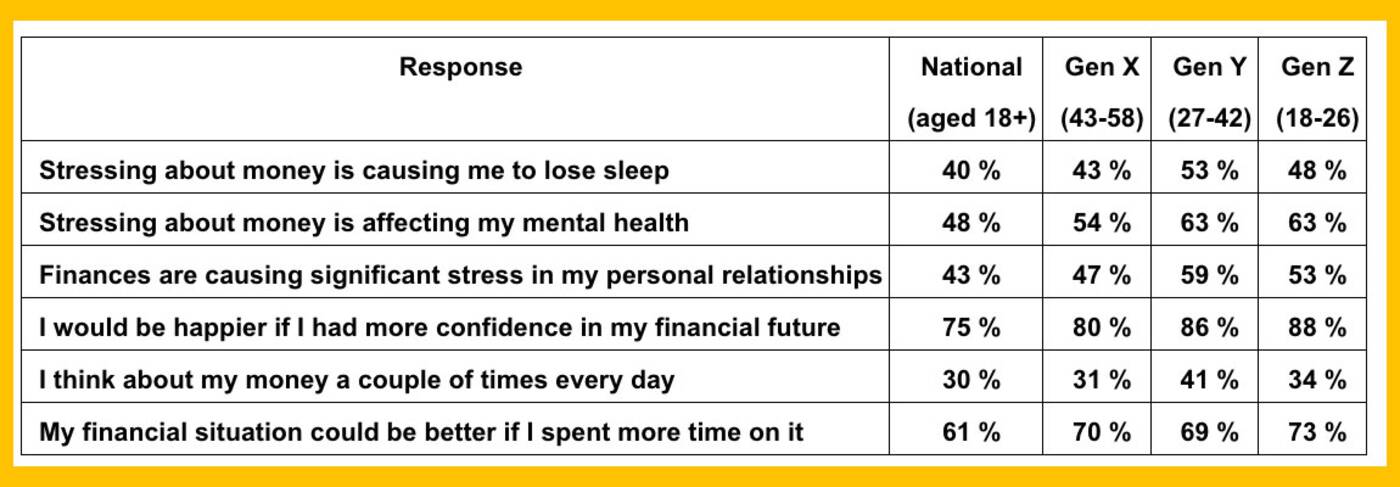

Compared to 40 per cent of all Canadian adults surveyed, Gen Y (millennials) are the most likely to have a difficult time sleeping because they are worried about their finances at 53 per cent, followed by Gen Z (48 per cent) and Gen X (43 per cent).

Similarly, 59 per cent of Gen Y, 53 per cent of Gen Z, and 47 per cent of Gen X report having “a significant amount of stress” in their personal relationships related to their finances, compared to the national average of 43 per cent.

RBC Royal Bank's survey results.

"We know personal well-being is closely tied to financial well-being, particularly for Canadians who are essentially living paycheque to paycheque or are uncertain about what the future holds," says Neil McLaughlin, group head of personal & commercial banking at RBC.

"Many Canadians deal with a lack of confidence when it comes to understanding their finances, which affects their ability to make sound financial decisions."

Interestingly, a high number of respondents said they'd be happier if they had more confidence in their financial future, topping out at 88 per cent among 18 to 26-year-old Canadians.

Shutterstock

Latest Videos

Latest Videos

Join the conversation Load comments