Many Canadian workers might get a sweet salary increase this year

While the economic outlook for many Canadians remains grim, a glimmer of hope remains that employers across the country are still planning on giving their employees planned salary increases.

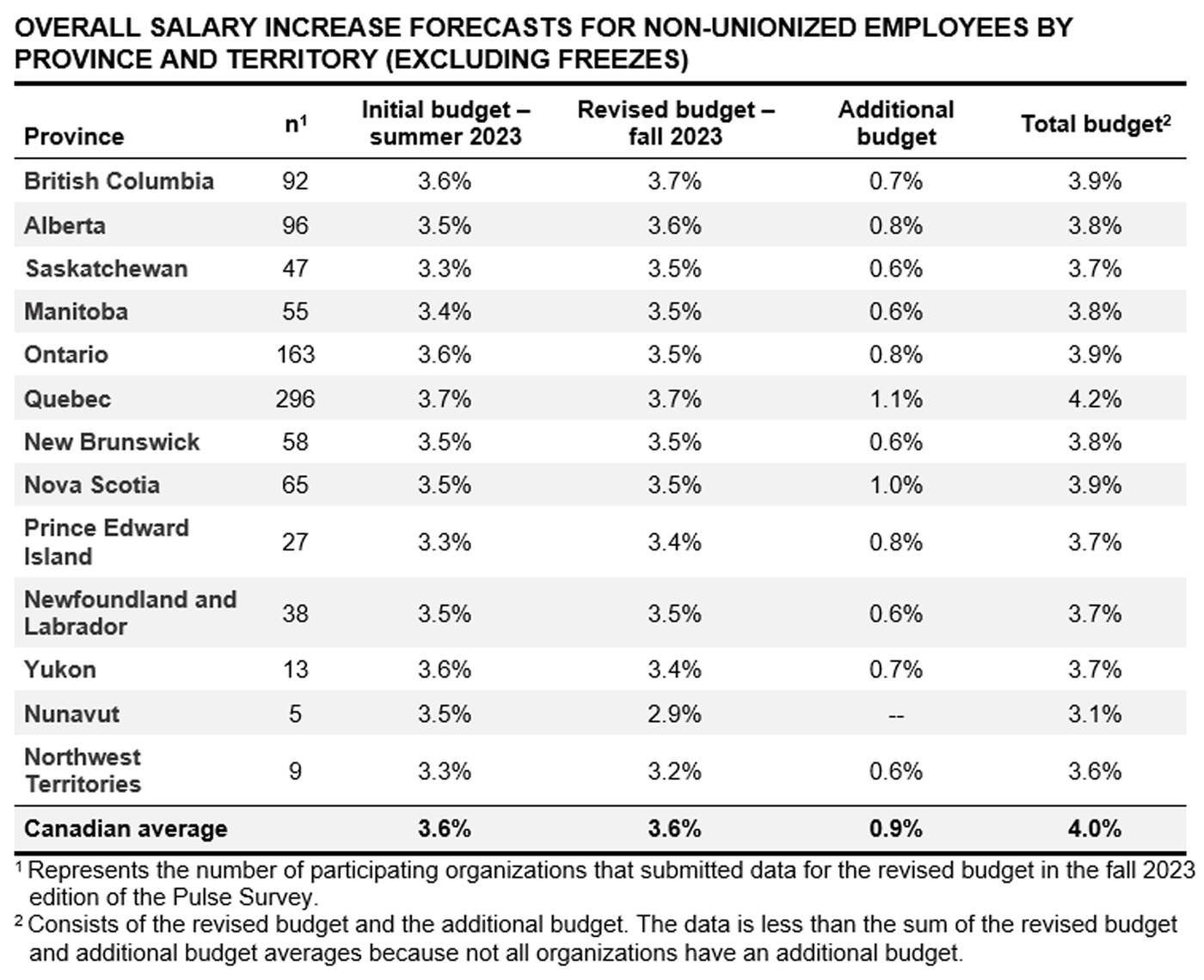

Normandin Beaudry, an actuarial consulting service, recently surveyed over 430 organizations across Canada for its Salary Increase Pulse Survey.

This survey intended to confirm Normandin Beaudry's 2024 salary forecasts from the summer, which reported that Canadian workers could see an average pay increase of 3.6 per cent.

Normandin Beaudry

Normandin Beaudry said that most Canadian organizations plan to keep an initial salary increase budget as "inflationary pressure slowly tapers off and the labour market begins to balance out."

Only 36 per cent of participating organizations reported changes to their initial budget projections from summer 2023. Over half of these organizations plan to lower their salary increase budget, while the remainder expect to increase their initial budget.

The consultancy said the results of its recent survey indicate that most participating organizations are still committed to investing in their employees' compensation packages to remain competitive in the current job market.

Aside from compensation increases, the majority of organizations that participated in the survey are also looking to add to their rewards portfolio to attract and retain talent. Some examples of this include organizations enhancing benefits and pension plans.

Despite possible salary bump, layoff worries persist

While pay increases could be on the way for some Canadians, many are concerned about losing their jobs.

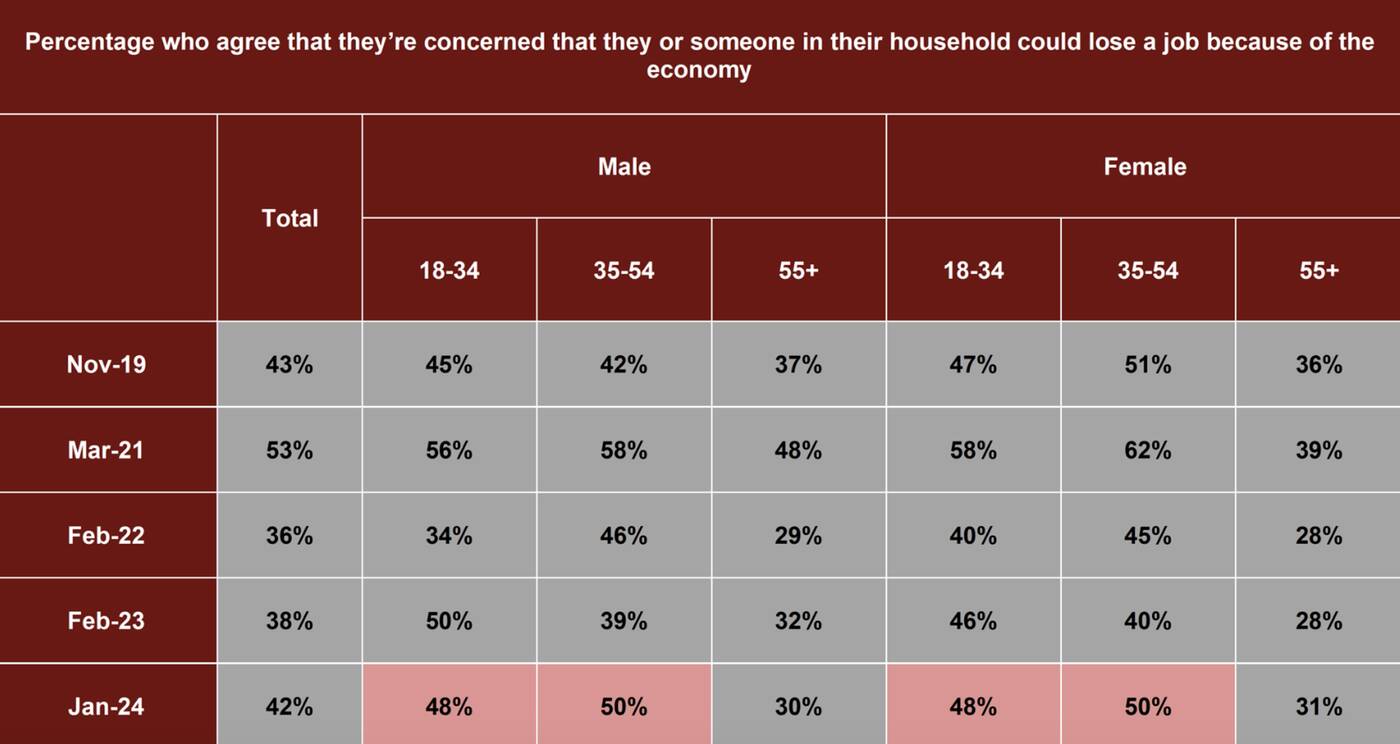

Half of Canadians under 55 worry that they will be impacted by layoffs because of the economy, per a report published by the Angus Reid Institute on Thursday morning.

Angus Reid

The last time fears around job loss were this high was during the second year of the COVID-19 pandemic, noted Angus Reid.

The survey also found that Canadians are struggling when it comes to emergency savings to fall back on if they are impacted by job loss.

The majority of survey respondents 55 and under said they could not be able to manage a surprise expense of over $1,000.

sockagphoto/Shutterstock

Latest Videos

Latest Videos

Join the conversation Load comments