Toronto home prices just dropped at a rate not seen in 22 years

It looks like the bubble may finally have popped—or at least stopped growing much bigger—for Canada's largest housing market.

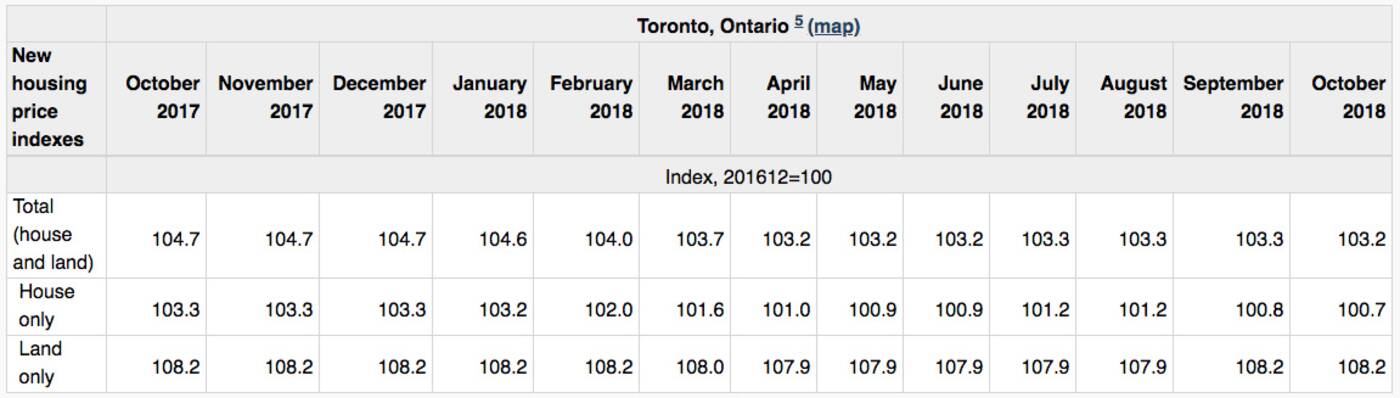

The average price of a new home in Toronto fell by 1.5 per cent in October, year over year, according to new data released by Statistics Canada on Thursday.

StatsCan's New Housing Price Index for October 2018 shows that, while the cost of a new house in Toronto fell just 0.1 per cent between September and October, it plummeted at a faster rate than we've seen since 1996 over the preceding 12 months.

The pace of construction on new, single-family homes also fell by a whopping 40.3 per cent in Toronto between October of 2017 and October of 2018 (though the condo market, it's safe to say, has been doing quite well).

Statistics Canada data shows the Toronto census metropolitan area dropping from 104.7 to 103.2 on the new housing price index in just 12 months. Image via StatsCan.

Bloomberg suggests this data further proves the success of government measures, introduced last year to help cool Toronto's too-hot housing market, such as tighter federal mortgage lending guidelines and Ontario's Fair Housing plan.

"The Bank of Canada also raised its trend-setting interest rate five times between July 2017 and October of this year," notes the business news agency. "New home prices were advancing at an annual pace of almost 4 percent late last year before the mortgage rules took effect."

Canada-wide, the picture isn't quite so harsh (unless you're looking to make money by selling a house).

The new home price index was up just 0.1 per cent, year over year, across the country as of October, which StatsCan says marks the smallest annual increase its seen since January 2010.

Two exceptions to the trend are the census metropolitan areas surrounding Windsor, up 0.9 per cent, and Ottawa, up 0.6 per cent.

Bully for them.

Latest Videos

Latest Videos

Join the conversation Load comments