Toronto home prices are triple what the average millennial can afford

Dear baby boomers who chide us yutes for not "buckling down" and "saving up" to buy homes we actually own: Shut up. And please read on.

A freshly-released report from Sutton Eaves and Dr. Paul Kershaw of UBC's School of Population and Public Health illustrates exactly how unrealistic the prospect of buying property is for young adults across Canada right now.

"Canadians between the ages of 25 and 34 continue to straddle a massive gap between housing prices that remain at near-historic levels in key parts of the country, and earnings for this age group that have been relatively flat, if not down, for several decades," reads the report, titled Straddling the Gap: A troubling portrait of home prices, earnings and affordability for younger Canadians.

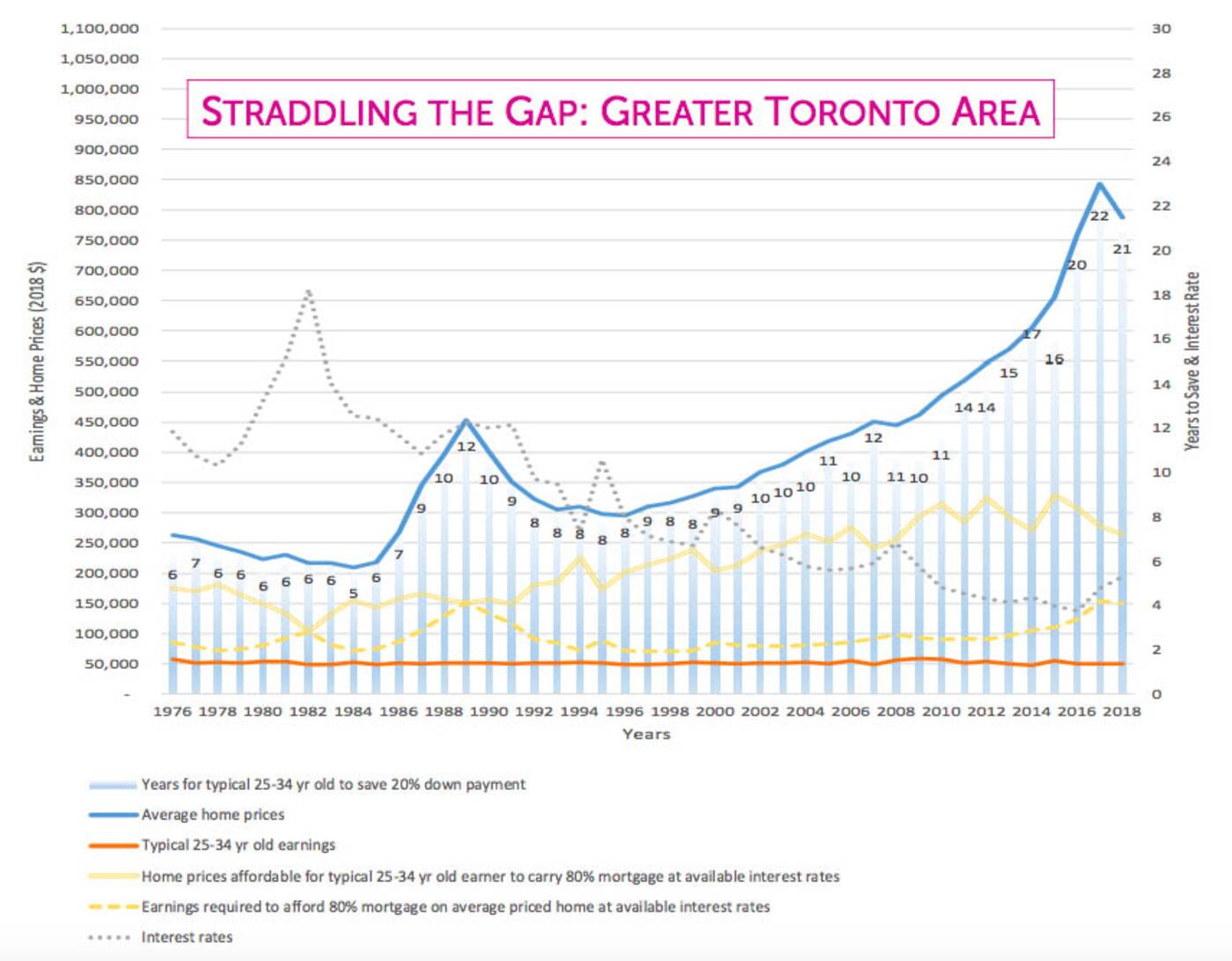

The average price of a Toronto area home has skyrocketed over the past four decades while earnings for 25-34 year olds have remained flat. Image via Generation Squeeze.

On average, a typical millennial worker would need to earn double their current salary to afford an 80 per cent mortgage on a standard home in Canada. That, or home prices would need to drop across the country by nearly half.

And these percentages rise steeply when it comes to large urban markets: Home prices are nearly quadruple what the average millennial can afford in Vancouver right now, according to the study, and triple what a young adult could afford in Toronto.

"Average home prices would need to fall $523,000 — two-thirds of the current value — to make it affordable for a typical young person to manage an 80 per cent mortgage at current interest rates," write Eaves and Kershaw of the Greater Toronto Area in particular.

"Or typical full-time earnings would need to increase to $150,000/year."

New @GenSqueeze study shows home prices still up to 4 times higher than what young Canadians can afford. https://t.co/RpGYBeMxEK #housing #millennials #affordability #cdnpoli #bcpoli #onpoli #cdnmedia

— Generation Squeeze (@GenSqueeze) June 12, 2019

"Based on the last decade, actual earnings are expected to be flat," the report continues. "It takes 21 years of full-time work for the typical young person to save a 20 per cent down payment on an average priced home [in the GTA] — 15 more years than when today's aging population started out as young people."

Being that the Canada Mortgage and Housing Corporation's definition of "affordability" means that a person does not spend more than 30 per cent of their pre-tax earnings on housing, the very prospect of affordable housing remains a distant dream for the leaders of tomorrow.

Generation Squeeze notes that, while there is no "silver bullet" that will solve Canada's housing problem, steps can be taken by all levels of government to shift policy framework and invest more into housing, child care, parental leave and transportation for young Canadians.

So, you see? We're not irresponsible. We're screwed.

blogTO

Latest Videos

Latest Videos

Join the conversation Load comments