It's better to rent than buy a condo in most Toronto neighbourhoods right now

Thinking of making the jump from condo renter to condo owner? From person who lives at home to person with their own place? From 905-er to proper Toronto resident?

It's either a great or a terrible idea right now, depending on who you ask — and the people most likely to share their opinions are often the least informed.

Experts in GTA real estate trends say it's more about where in the city you want to live at any specific point in time than when you choose to purchase or sign a lease.

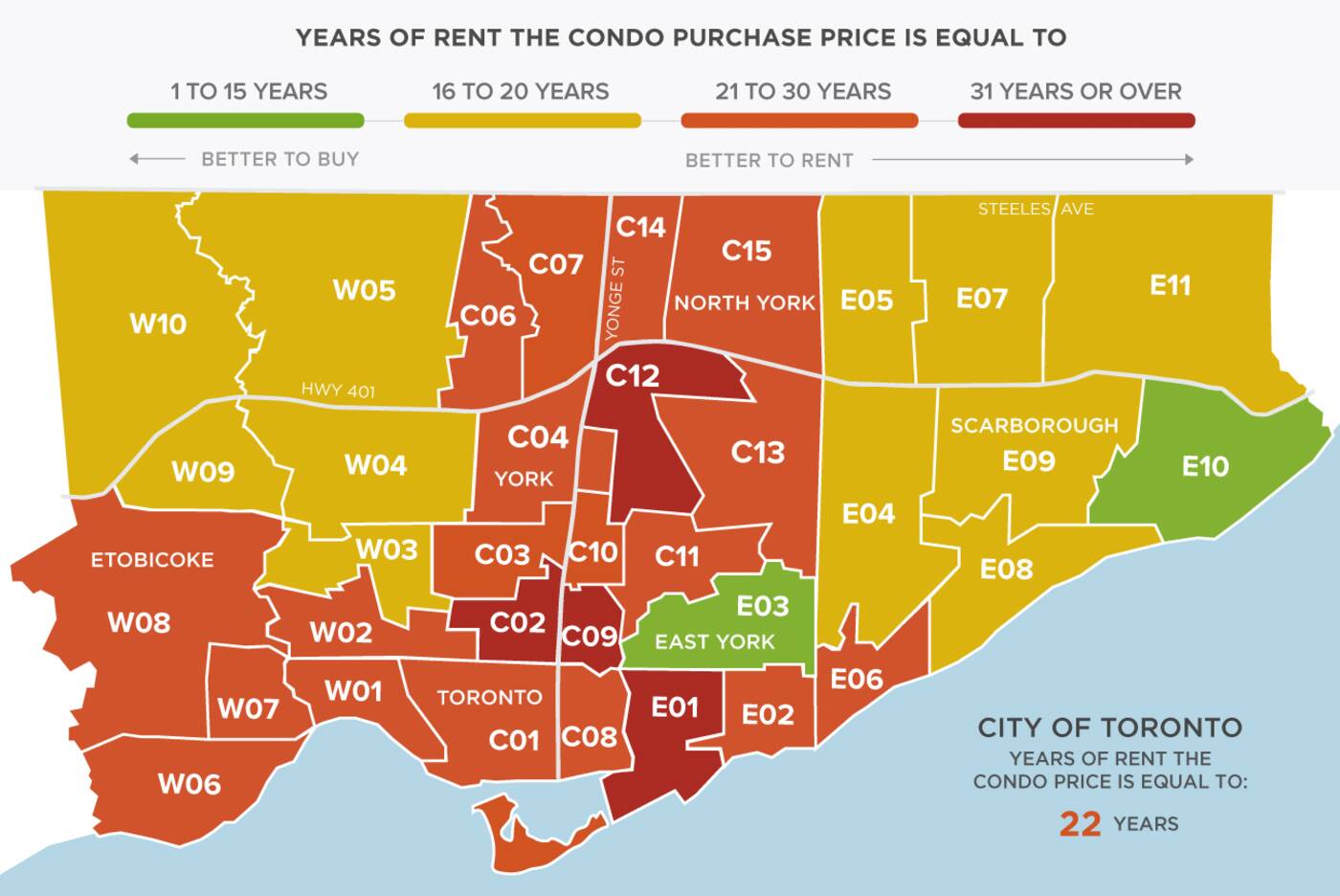

A new report from the brokerage and analysis firm Zoocasa breaks down the price-to-rent ratio (PTRR) for 35 neighbourhoods across Toronto.

Based on Toronto Regional Real Estate Board data from the second quarter of 2020, the analysis attempts to "highlight neighbourhoods where it may be better to rent a condo apartment, and where it may be better to buy."

"Our findings reveal that across the City of Toronto, the average condo apartment purchase price from Q2 2020 was equal to about two decades worth of rent," reads the Zoocasa report.

"With the average condo price of $661,458 and the average monthly lease rate of $2,501, the price-to-rent ratio in the City of Toronto was 22."

This means that the average condo price in Toronto at present is worth 22 years worth of today's average rental rates — not a good number, according to Zoocasa, which explains that any ratio over 21 suggests it's better to rent than to buy. A ratio of between one and 15 suggests that buying offers the better value.

"Of the 35 neighbourhoods included in our analysis, 22 had a PTRR of at least 21 years, indicating that overall, renting a condo apartment may currently offer more value than purchasing one in the majority of Toronto neighbourhoods," reads the report.

"Only two neighbourhoods had a PTRR of 15 or under."

The two Toronto neighbourhoods in which realtors would recommend buying as opposed to renting right now, based on their PTRR metrics, are TRREB district E03 (East York, Danforth Village) and district E10 (West Hill, Centennial Scarborough).

"Renters in these neighbourhoods could consider the leap into home ownership," states Zoocasa. "With a PTRR of 15, the average condo purchase price is equal to 15 years worth of rent in both neighbourhoods."

With a PTRR of 17, TRREB destrict E11 (Malvern, Rouge) may also offer housing opportunities in which you'd be better-advised to buy a condo than rent one at the average market rate.

"While the PTRR does not account for affordability factors like the carrying costs of home ownership (e.g. mortgage payments, property taxes, or condo maintenance fees) and the income required to qualify for a mortgage, the PTRR is a helpful metric for comparing home prices to rental rates across different neighbourhoods," notes Zoocasa.

Here are the five neighbourhoods with the lowest price-to-rent ratio (read: the best value for buying vs. renting) as of Q2 2020:

- E03 – East York, Danforth Village

Condo purchase price: $434,196

Condo lease rate (monthly): $2,415

PTRR: 15 - E10 – West Hill, Centennial Scarborough

Condo purchase price: $352,500

Condo lease rate (monthly): $1,933

PTRR: 15 - E11 – Malvern, Rouge

Condo purchase price: $405,518

Condo lease rate (monthly): $2,024

PTRR: 17 - W05 – Black Creek, York University Heights

Condo purchase price: $434, 340

Condo lease rate (monthly): $2,140

PTRR: 17 - W10 – Rexdale-Kipling, West Humber-Claireville

Condo purchase rate: $438,047

Condo lease rate: $2,124

PTRR: 17

And here's where you'll find the highest price-to-rent ratios in Toronto right now — or rather, the neighbourhoods in which renting is currently a better value than buying:

- C09 – Rosedale, Moore Park

Condo purchase price: $1,307,658

Condo lease rate: $2,501

PTRR: 35 - C12 – York Mills, Bridle Path, Hoggs Hollow

Condo purchase price: $1,257,600

Condo lease rate: $3,108

PTRR: 34 - E01 – Leslieville, Riverside, Little India

Condo purchase price: $868,112

Condo lease rate: $2,202

PTRR: 33 - C02 – Yorkville Annex, Summerhill

Condo purchase price: $1,119,482

Condo lease rate: $3,020

PTRR: 31 - C08 – Regent Park, St. James Town, Corktown

Condo purchase price: $734,172

Condo lease rate: $2,239

PTRR: 27

You can view the full report from Zoocasa to see how all 35 neighbourhoods in Toronto stack up in terms of price-to-rent ratio.

Latest Videos

Latest Videos

Join the conversation Load comments