Toronto apartment vacancy rates just reached a 50-year high

Toronto's rental market continues to morph beyond anything we could ever have expected over the course of just one year as the COVID-19 pandemic drags on and people leave their tiny glass sky homes in droves.

Urbantion, which has been keeping track of and analyzing the condo and rental apartment markets in the GTA since 1981, reported a staggering increase in the city's average vacancy rate on Monday when releasing the results of its Q4-2020 rental market survey.

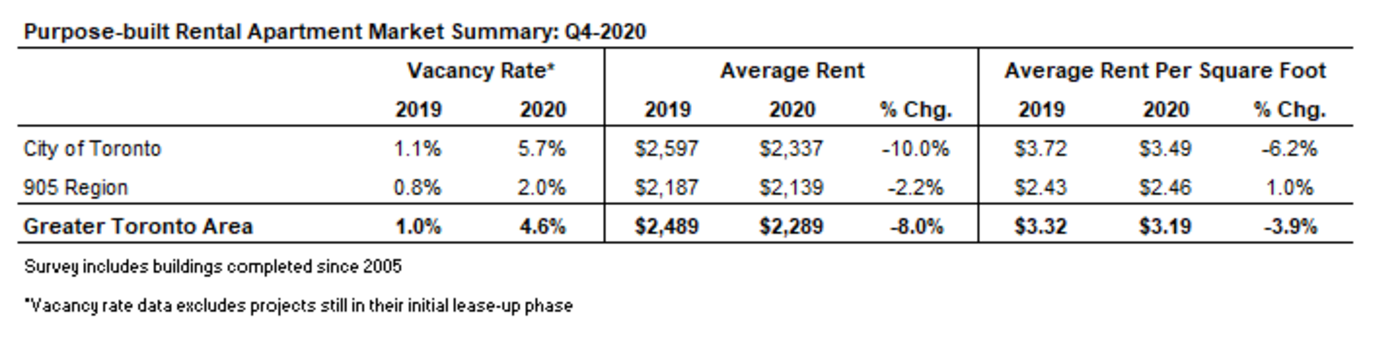

Up from just 1.1 per cent last year at this time, the City of Toronto now boasts a whopping 5.7 per cent vacancy rate among newer purpose-built rental apartments (read: those built since 2005.)

This is a high vacancy rate for any major Canadian city, let alone one that has been holding steady at below 2 per cent for years.

In fact, according to Urbanation, it's a new all-time record high: "The latest surveyed rental vacancy rate represents a 50-year high when examining historical CMHC survey data for Toronto back to 1971."

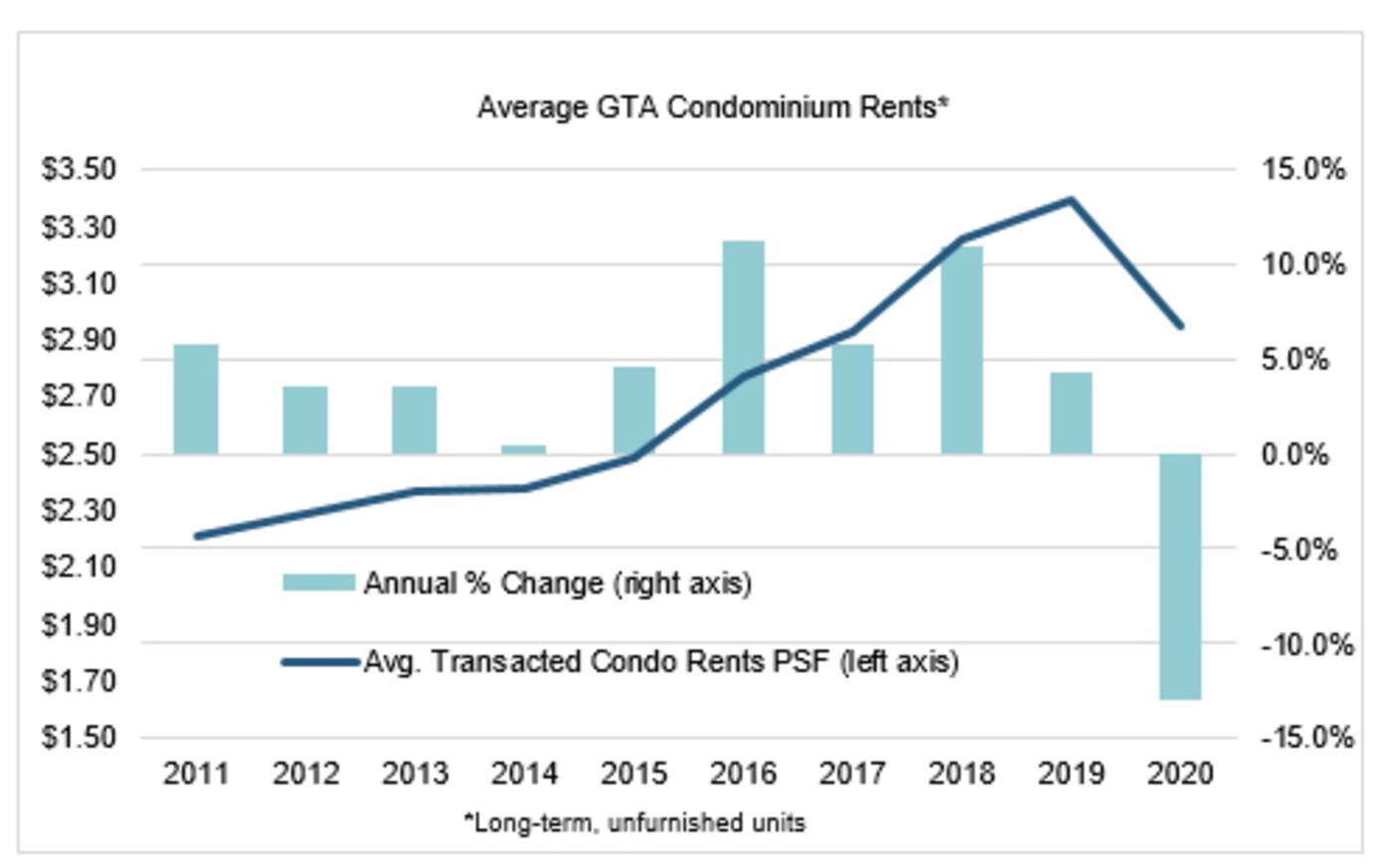

High vacancy rates are sinking rent prices for both condos and purpose-built rental apartment projects in the GTA. Image via Urbanation.

The historic link between low vacancy rates and higher-than-normal rent prices is also glaringly apparent in Urbanation's latest stats: Rents have been falling drastically in Toronto alongside rising vacancies.

"Average rents for purpose-built units that became available for rent during Q4-2020 declined 10.0 per cent year-over-year in the City of Toronto to $2,337 in Q4-2020, with average per square foot rents down 6.2 per cent year-over-year to $3.49 psf.," notes the firm.

For condo rentals, prices fell even further, some 14.1 per cent year-over-year to reach just $2,076 last quarter.

"Rent declines were steepest in the former City of Toronto mainly representing the downtown markets, with average per square rents down 17.2 per cent year-over-year in Q4-2020 to $3.14 psf ($2,104)," writes the firm, noting that the number of new units coming available for rent last year increased substantially.

"Rental lease transaction volume in the GTA increased 25 per cent in 2020 to a record high of 38,366 units. However, the number of units that became available for rent last year increased by 46 per cent, resulting in a 162 per cent annual increase in year-end active listings to a record high 8,066 units," reads the Urbanation report.

"Two-thirds of all lease activity in 2020 occurred during the second half of the year as renters took advantage of rent discounts."

Rents are way down in the City of Toronto amid soaring vacancy rates. Parts of the GTA outside of the city have experienced similar trends, but to a lesser extent. Image via Urbanation.

While rent prices dipped and vacancy rates soared in downtown Toronto last quarter, the same cannot be said for other parts of the GTA: In the 905 region, vacancy rates rose just 0.8% inbetween Q4 of 2019 and 2020, reaching 2.0 per cent last month.

"The still low vacancy rate in the 905 can be attributable to a relatively limited amount of rental stock and increased population outflows from the City of Toronto," notes Urbanation.

"The overall vacancy rate for the Greater Toronto Area was 4.6 per cent in Q4-2020, up from 1.0 per cent in Q4-2019."

Rents also declined at a milder pace for the same category of residential units in GTA regions outside Toronto, down 2.2 per cent to reach an average of $2,139 per month.

"When excluding new buildings with typically higher rents that finished construction in 2020, average GTA purpose-built rents declined 8.9 per cent year-over-year (down 5.7 per cent on a per square foot basis)," reads the report, which was released on Monday.

"The reported decline in rents was additional to incentives," continues Urbanation, referring to promotions such as two months of free rent offered by building managers lately in an attempt to attract new tenants.

The number of lease transactions for rental condos is up in the GTA, but listings have also spiked drastically as people move out of their small, pricey units. Image via Urbanation.

It's hard to say where things will go from here in terms of demand for rentals, but we do know that supply is increasing at rates faster than we've seen in decades.

A total of 18 new purpose-built rental projects (15 in Toronto and three in the 905) are slated for completion in 2021, which would result in 4,977 new units hitting the market — the highest number recorded since 1993.

"The GTA rental market faced its toughest challenges to date in 2020 due to COVID-19," said Urbanation president Shaun Hildebrand of the trends.

"While rents have a long way to go before returning to their peak and supply will continue to be a headwind in the near-term, some improvement can be expected in 2021 as vaccinations eventually lead to higher immigration and at least a partial return to the office for downtown workers and in-class learning for post-secondary students."

Hector Vasquez

Latest Videos

Latest Videos

Join the conversation Load comments