Toronto's high-risk housing market could be in for a rude awakening

Toronto's red-hot real estate market could be in trouble according to a Housing Market Assessment report from the Canada Mortgage and Housing Corporation (CMHC) that points to a growing imbalance between national home prices and income.

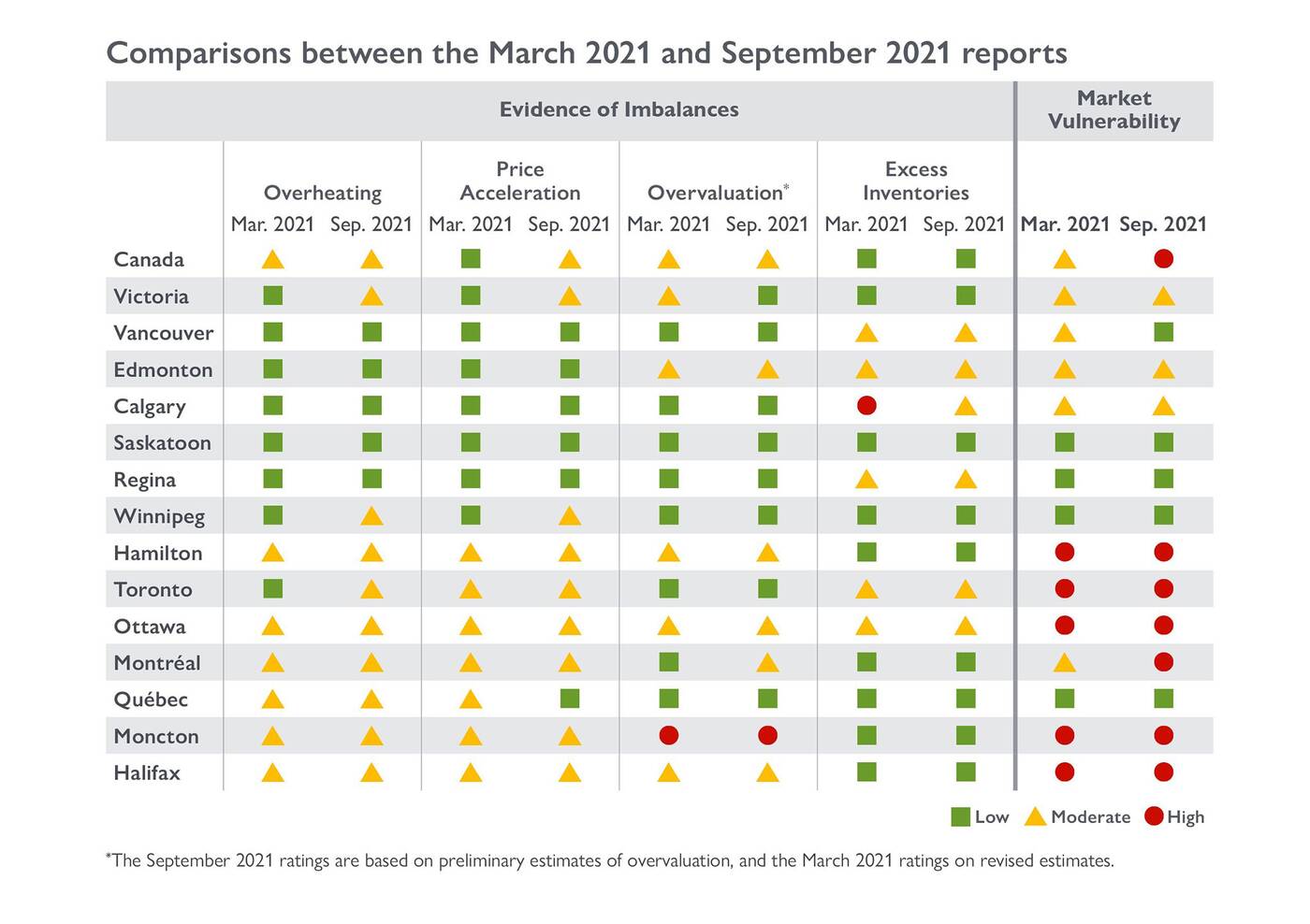

A mix of moderate price acceleration and overvaluation are combining for high market vulnerability in many parts of the country, including the Greater Toronto Area (GTA) region.

The GTA market is experiencing a continuation of conditions seen for the past several months. But something has changed, with moderate overheating now added to an already unstable situation and furthering the risk of a potential market downturn.

Factors including historically low interest rates and government supports fueled a market boom after the rollout of mass vaccination programs. This could be seen on paper when the average GTA home price shot upwards by 12.6 per cent year-over-year in August, reaching a stratospheric $1,070,911.

"Exceptionally strong demand and home price appreciation through the course of the pandemic may have contributed to increased expectations of continued price growth for homebuyers in several local housing markets across Ontario and Eastern Canada," said Bob Dugan, CMHC's chief economist.

"This, in turn, may have caused more buyers to enter the market than was warranted."

The GTA market is just as vulnerable as it was six months ago, despite the easing of excessive home sales after the pandemic bounceback months. There is still a hefty imbalance between demand and supply, pushing home prices ever higher.

Housing Market Assessment. Image courtesy of CNW Group/Canada Mortgage and Housing Corporation.

Even beyond the immediate GTA, other cities in the region are facing similar conditions. In Hamilton, the CMHC warns of continued market vulnerability, citing prevalent overheating, price acceleration and overvaluation.

Similar stories are unfolding in cities across the country, as the number of home sales broke records in the first quarter of the year, with continued market overheating even as the post-vaccination buying frenzy subsided.

Jack Landau

Latest Videos

Latest Videos

Join the conversation Load comments