Huge dip in sales may mean the downturn of Toronto's housing market has started

With prices now at ridiculous highs hardly anyone can afford and lending interest rates on the rise, real estate experts have been predicting a cool-down for Toronto's red-hot housing market — and based on the latest numbers, it may have already begun.

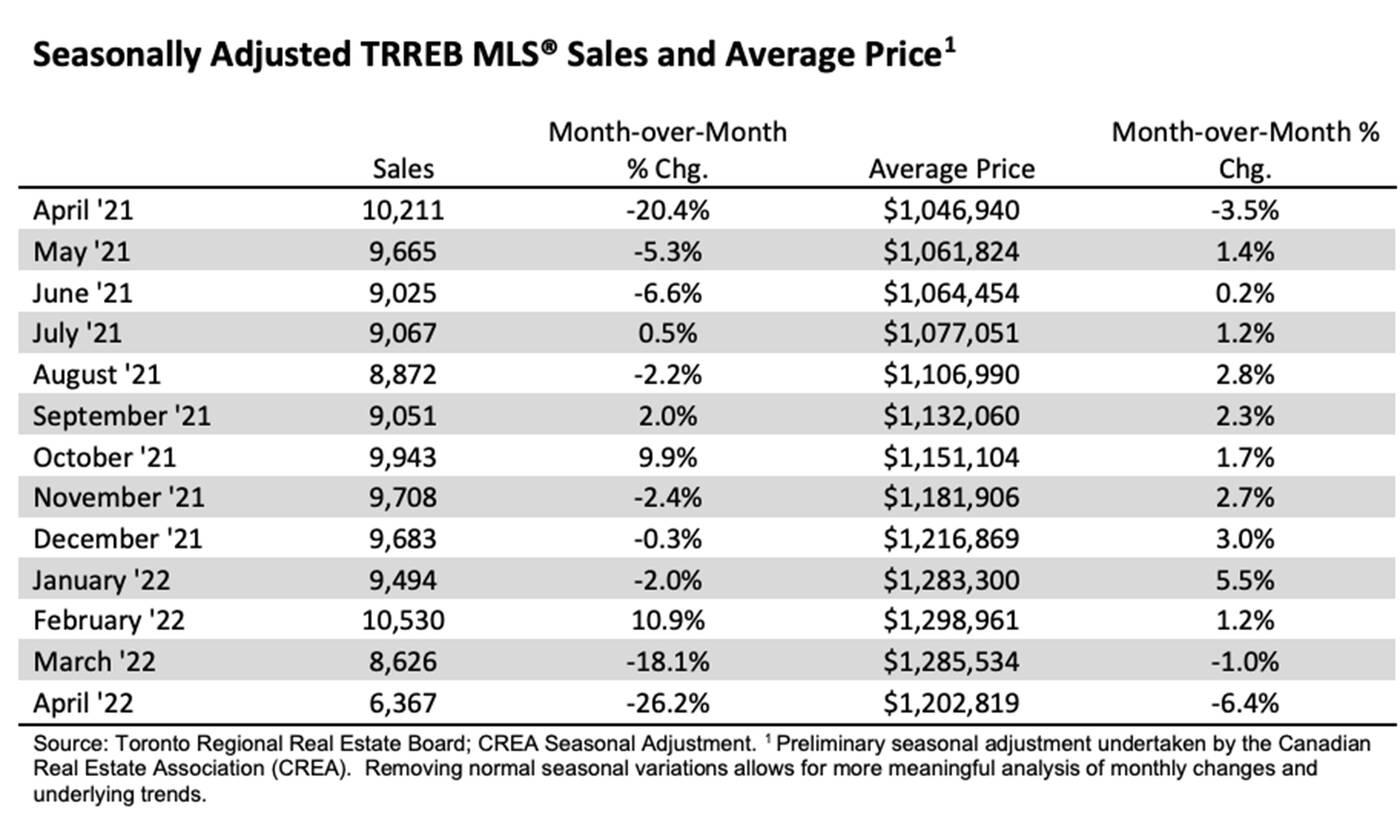

The Toronto Regional Real Estate Board's latest report for April shows that the number of home sales across the GTA are falling drastically, down 27 per cent month-over-month, and a whopping 41.2 per cent compared to the same time last year, even given the state of the pandemic at that time.

The group attributes this, in large part, to the fact that "negotiated mortgage rates rose sharply over the past four weeks, prompting some buyers to delay their purchase," an expected and even planned result of the hikes.

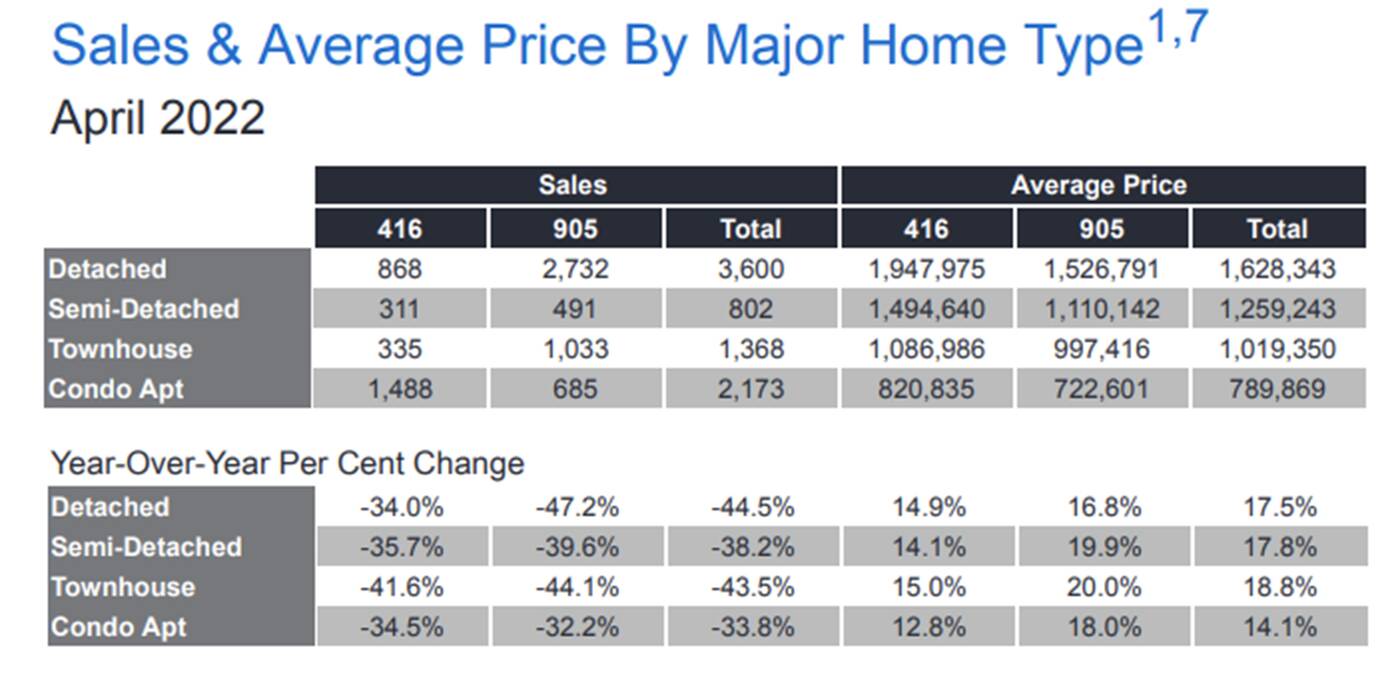

Chart showing the latest GTA home sales and price numbers, from TRREB's April 2022 Market Watch report.

The drop in activity was more notable in the 905 than the 416 — perhaps a result of people coming back into the city after the mass exodus spawned by COVID fears, lockdown closures and work-from-home trends — especially for larger, pricier detached houses.

While only 8,008 homes were sold in the region overall last month, prices are still far higher than April 2021, with TRREB reporting an MLS Home Price Index Composite Benchmark increase of a whopping 30.6 per cent and an average price increase of 15 per cent.

But, when looking at the figures month-over-month, prices actually tumbled slightly: the average price of a home of any size and type anywhere in the GTA was $1,254,436 last month versus $1,300,082 the month prior.

Chart comparing GTA home sales volumes and prices over time, from TRREB's April 2022 Market Watch report.

While authorities like RBC have said they're expecting pretty major price declines in hubs like Toronto this year, those at TRREB seem less sure of a substantial downturn, especially due to the province's housing supply crisis and the continued trend of investors buying up multiple properties for profit.

"There is evidence of buyers responding to increased choice in the marketplace, with the average and benchmark prices dipping month-over-month. It is anticipated that there will be enough competition between buyers to support continued price growth relative to 2021," their report reads, noting that the pace of growth will indeed "moderate" in the coming months.

"Policymakers should not assume that because home sales are off their record peak, we can ignore the lack of inventory in the market. Buyers who have moved to the sidelines will not remain there forever, and the population of our region will continue to grow on the back of immigration. In the absence of new supply, we will build a significant amount of pent-up demand that will need to be satisfied in the not-too-distant future."

Latest Videos

Latest Videos

Join the conversation Load comments