Housing sales in Toronto are dropping so much that it's becoming a buyer's market

It may have been hard to believe real estate experts when they predicted that the ridiculous Toronto housing market would cool down this year, but it seems that some big changes are beginning to happen in sales, in part due to rising mortgage interest rates.

April figures saw far fewer homes switching hands compared to the month and year prior, with transactions down 27 per cent month-over-month and a whopping 41.2 per cent year-over-year in the GTA.

And though prices are still bonkers at around $2 million for a detached home and more than $820,000 for a condo in the city proper, stakeholders are now saying that we're heading into more of a buyers' than a sellers' market for the first time in a long time.

BMO Chief Economist Douglas Porter issued the forecast this week due to the fact that the ratio of sales to new listings across Canada fell from 76 per cent to 66 per cent, which is on the precipice of what the Canadian Real Estate Association (CREA) deems a balanced market.

In the GTA specifically, this number dropped to a far lower 45 per cent, which Porter said in a release is "suddenly getting into buyers market terrain."

BMO: Toronto housing market "suddenly getting into buyers market terrain" (in terms of sales/new listings) pic.twitter.com/zZcx0Fc93g

— Scott Barlow (@SBarlow_ROB) May 17, 2022

The CREA itself also notes in its latest report that "housing markets in many parts of Canada have cooled off pretty sharply over the last two months," crediting lending rates and also buyer fatigue for the change.

"For buyers, this slowdown could mean more time to consider options in the market. For sellers, it could necessitate a return to more traditional marketing strategies," the group writes.

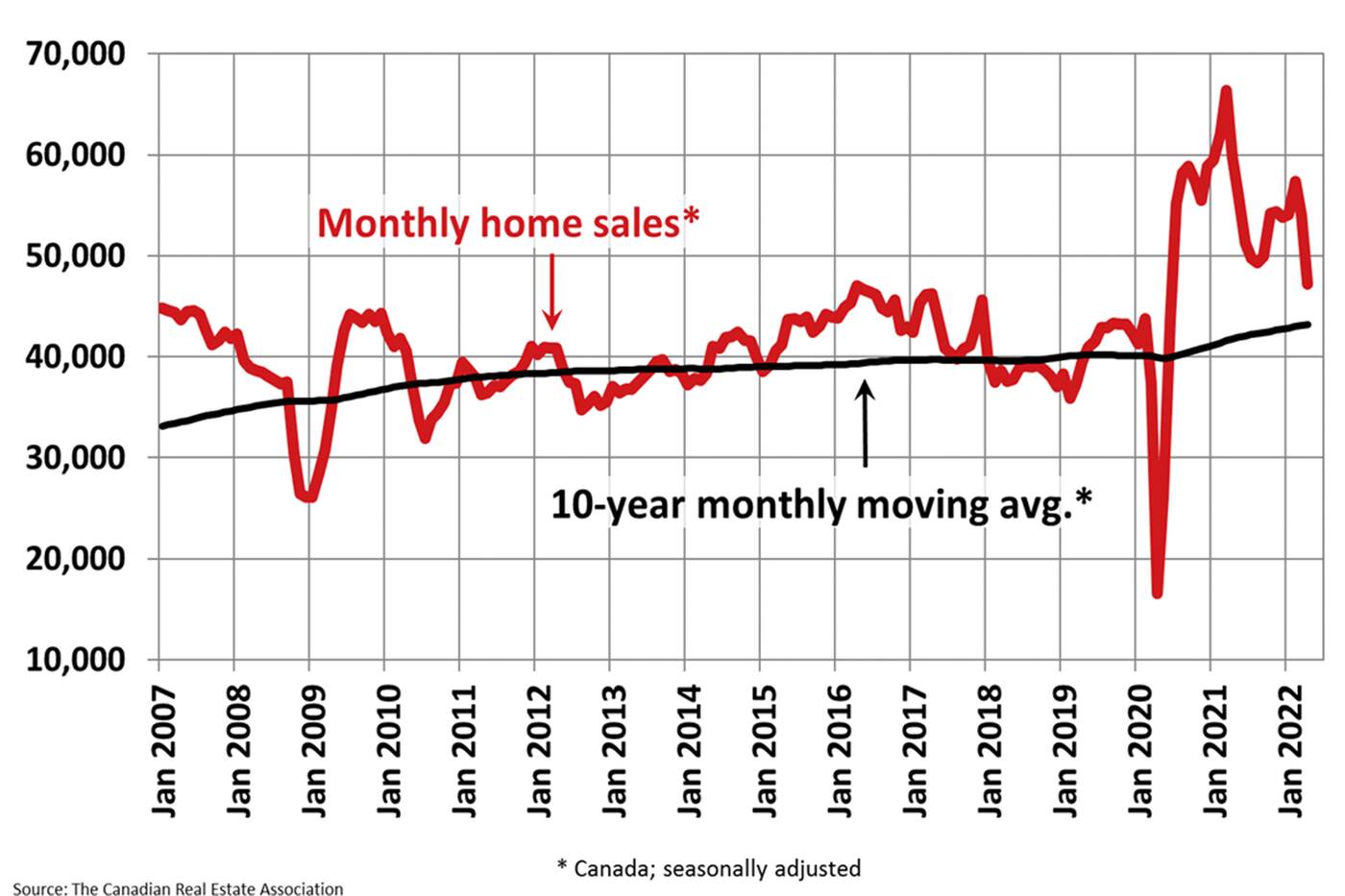

CREA chart showing how the volume of home sales nationwide has changed over time.

While supply remains tight, interest appears to be lessening due to a number of factors, meaning less bidding wars and houses going for exorbitantly more than asking price.

Many new homeowners in a city where housing has long been touted as a lucrative, sure investment are now experiencing buyer's remorse as a result.

With sales now falling off, Porter says that the market is about three months away from lower prices, as "decades of history show that the sales-to-new-listings ratio is an excellent leading indicator for average transactions prices."

Rising interest rates, high prices and people have given up

— SV (@mytweets1234567) May 4, 2022

Depending on how drastic the shift, the GTA rental market — in which prices are due to keep rising unless something major changes — may also be impacted, as will the smaller Ontario towns where housing price points have been rising to never-before-seen highs due to people leaving the city.

Latest Videos

Latest Videos

Join the conversation Load comments