Home prices expected to plummet across Ontario but Toronto should remain red hot

Toronto and the broader Ontario housing market surged in the pre-lockdown days, though the sudden switch to work-from-home conditions brought on an urban exodus, in turn driving up prices in suburban and rural markets.

A gradual return to normal has many office workers moving back to big cities, while other factors like soaring inflation and the Bank of Canada's moves to tighten interest rates have experts warning that home prices could be on the way down across the country.

Just not in major urban centres like Toronto.

According to the latest Canadian Residential Real Estate Outlook from Desjardins Economic Studies, "Canadian provinces and the country as a whole are expected to see home prices decline but remain above their pre-COVID levels," with the caveat that "individual communities will be impacted very differently. "

The report states that the average Ontario home price rose by approximately 13 per cent in the two years before the pandemic hit, though this growth was completely eclipsed by the over 60 per cent gains registered in the province from Dec. 2019 to Feb. 2022, prices climbing substantially from $645,000 to $1,040,000.

Experts at Desjardins state that this February high represented a price peak that may end up being the high water mark of the Canadian housing market, meaning the country has nowhere to go but down (and back towards the realm of relative affordability.)

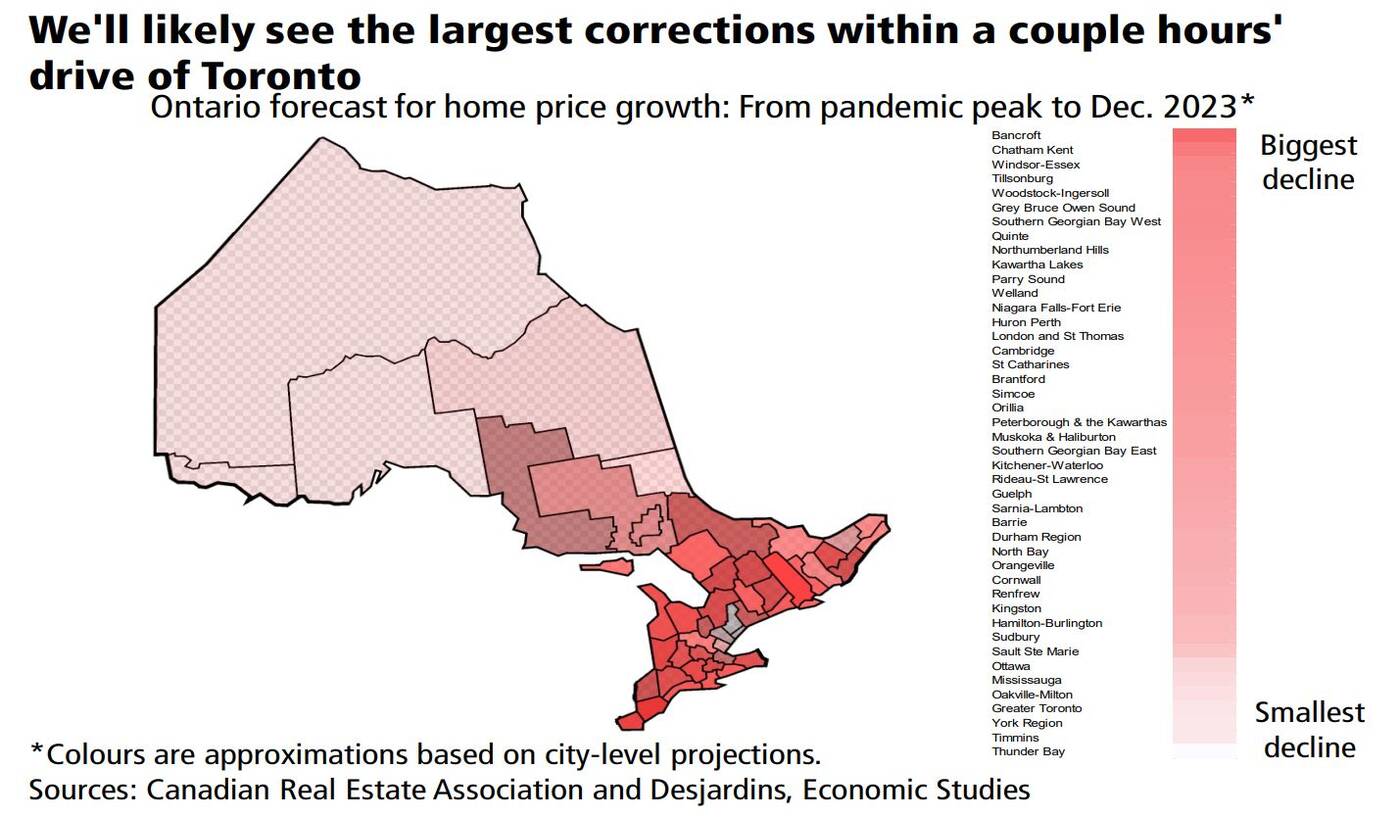

Desjardins predicts that this unsustainable growth will see some smaller communities' prices plummet this year, stating that "It's difficult to envision the housing markets of some smaller communities maintaining their unprecedented pandemic price gains as people return to in-person work on a more regular basis."

Bancroft, Ontario is predicted to see the largest declines in the entire province, Desjardins forecasting prices to plummet from the 185 per cent gains registered since Dec. 2019.

Average home prices in Toronto increased by roughly 50 per cent in that same 2019-2022 period, while prices in surrounding communities absolutely exploded, jumping by over 70 per cent to over $825,000.

These factors have helped Toronto and other Ontario cities ascend (or descend depending on your perspective) to among the least affordable in the country as of the first quarter of 2022.

And don't expect that to change any time soon, as Desjardins' map of Ontario is a wall of red shading (indicating price declines) surrounding a small pocket of grey representing the Greater Toronto Area, and the unlikelihood of any substantial decline in home prices.

Map showing projected home price declines with the largest shaded in red and the smallest shaded in grey. Image by Desjardins.

While Thunder Bay is expected to see the smallest declines of any city in Ontario and Timmins not far behind, the Greater Golden Horseshoe region takes the next four spots on the list, with York Region, the Greater Toronto Area, Oakville-Milton, and Mississauga.

The Desjardins report suggests that "proposed legislation to end blind bidding and other practices believed to be leading causes of recent price appreciation should also bring down home prices somewhat."

It's not all doom and gloom for investors, though, as Desjardins notes that they "don't anticipate average home prices in any of these regions to fall below their pre-COVID starting points due by and large to high levels of international migration and ongoing hybrid work arrangements."

Jack Landau

Latest Videos

Latest Videos

Join the conversation Load comments