Hardly anyone is buying condos in Toronto anymore as market keeps plummeting

While renters in Toronto are competing neck-and-neck for apartments that keep going up in price, the city's housing market is in a very different situation that would better be described as "in hot water" than "red-hot."

The number of residential real estate sales in the GTA has been dropping dramatically for months now, while the number of listings are likewise reaching scary lows, and homes are sitting on the market unsold for way longer, prompting more and more terminated listings.

According to the latest numbers from the Toronto Regional Real Estate Board, the usually extremely high demand for condos in the region has waned, with a whopping 46 per cent fewer sold in the third quarter of this year than during the same time last year.

When looking monthly, other organizations have pegged this as an even more shocking fall: down 89 per cent year-over-year and 84 per cent from the ten-year average, per the Building Industry and Land Development Association (BILD).

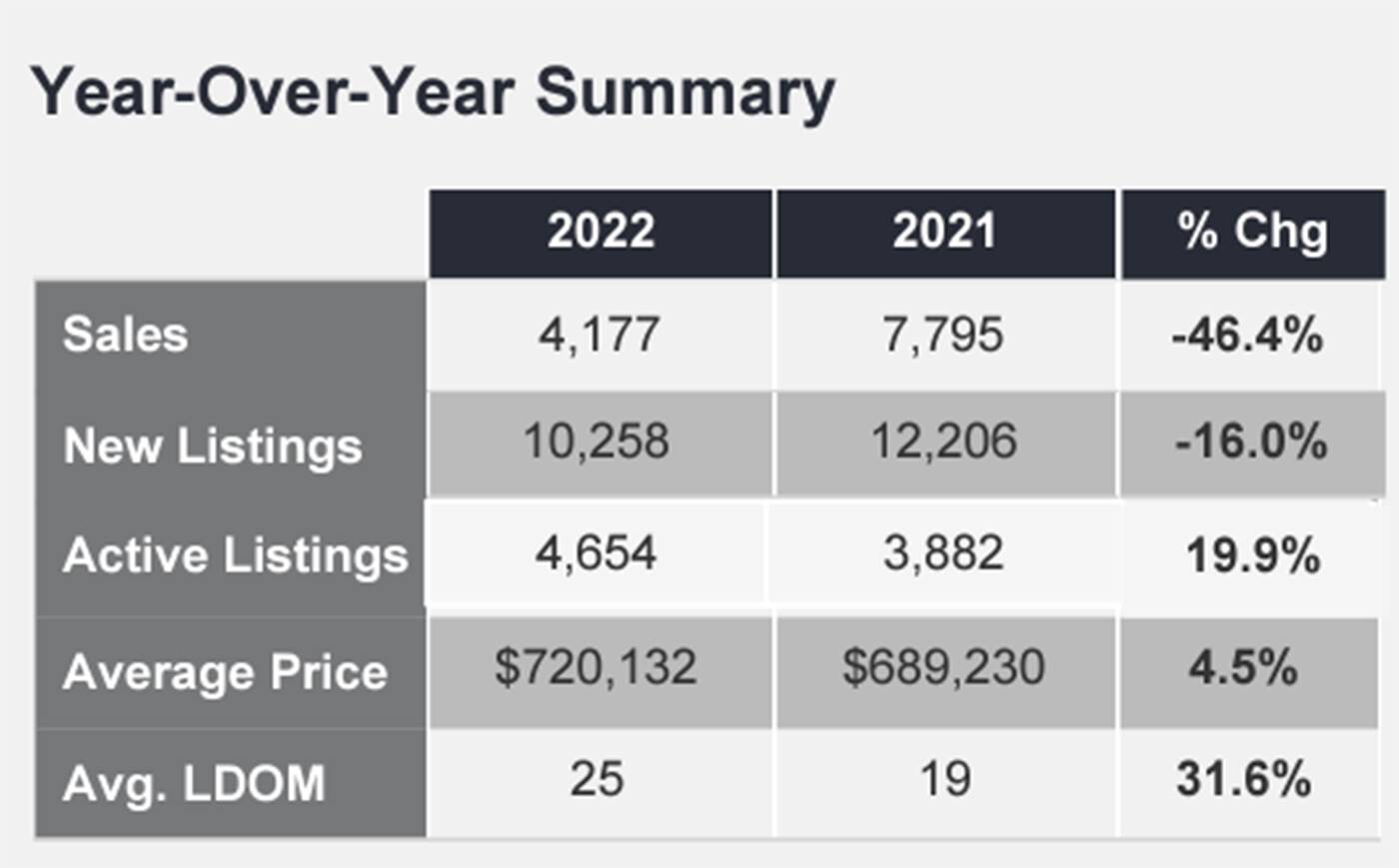

Both the number of new condo listings and the number of sales are down substantially in the GTA year-over-year this quarter, while price has increased slightly and units are staying on the market for longer. Chart from TRREB's latest condo market report.

TRREB says condo listings, meanwhile, were likewise fewer and farther between in this year's Q3 compared with 2021's, though to a lesser degree than purchases (16 per cent).

The organization attributes this to, of course, higher mortgage interest rates and living expenses amid inflation, which has forced a large portion of prospective buyers out of the game until the economy is in a better place.

The board says that as the pace of growth of this very important segment of the market has slowed, many would-be buyers "have shifted to the condo rental market in the short-to-medium term to meet their housing needs," which explains why rentals in the GTA are so pricey and hard to secure lately.

While condo prices have not increased as high as the rate of overall inflation, they remain high at an average of $720,132, meaning the added cost of borrowing is absolutely not worth it.

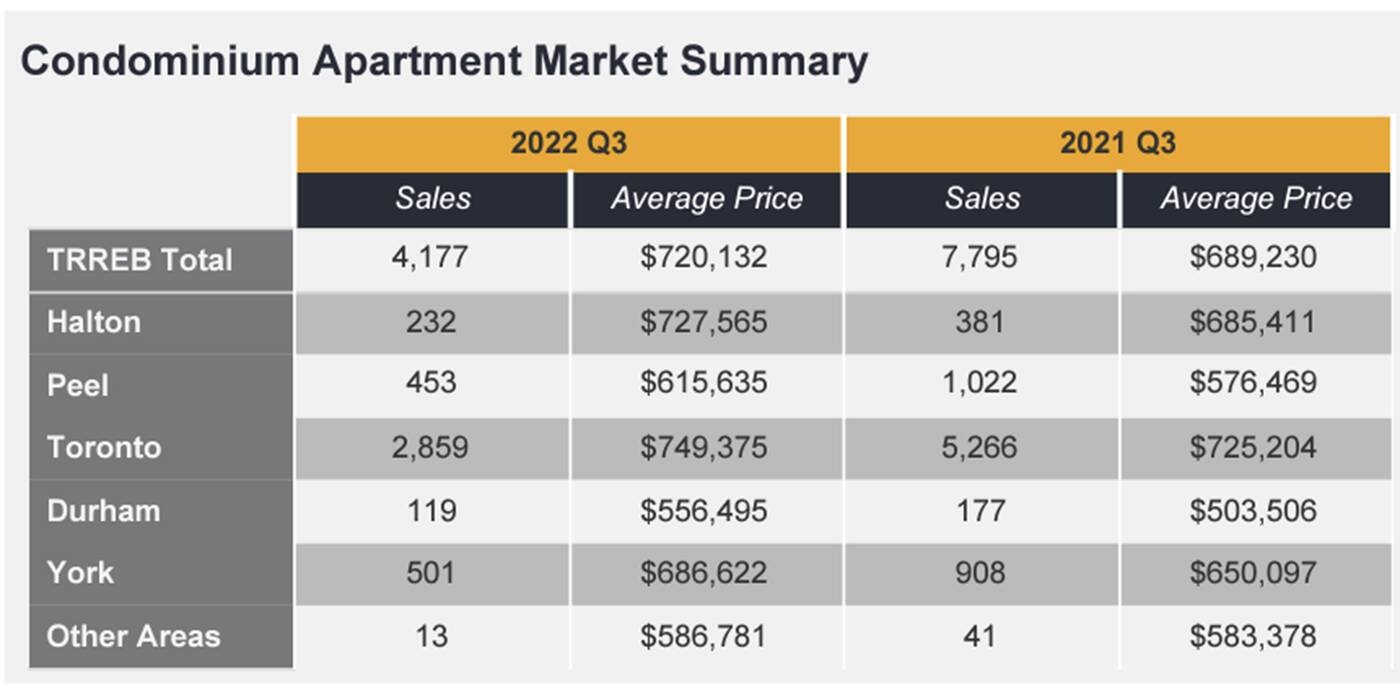

A breakdown of sales volumes and average price in different parts of the GTA this quarter versus the same time last year. Chart from TRREB's latest condo market report.

And, due to the fact that available supply for sale continues to fall alongside sales, TRREB says prices are likely to remain high enough to keep people sidelined as the impact the tanking market has had on price "has been mitigated to a certain degree by a dip in listings over the same period."

Residents can add in the fact that it's a bad time to buy, sell or rent to the rest of their financial woes lately, which include profiteering retailers and sky-high prices for groceries and basically every other purchase and bill.

Latest Videos

Latest Videos

Join the conversation Load comments