Housing will get more affordable in Toronto next year if experts are right

With housing costs as astronomically high as they are in Toronto and surrounding areas, it feels like there's nowhere for real estate prices to go but down.

And yet, people have been errantly thinking that on and off for a very long time.

A new report from the economists at Desjardins suggests that affordability could actually, finally improve a bit in 2023 thanks to a number of factors including rising interest rates and post-pandemic market corrections.

"Despite taking a brief reprieve in August, home prices and sales are expected to continue their downward slide. This is largely

due to the ongoing rise in interest rates and borrowing costs facing households," reads the newly-published Desjardins Canadian Residential Real Estate Outlook.

"We remain of the view that those provinces that experienced the most pronounced pandemic gains will also see the most precipitous post-pandemic corrections."

Among those provinces are the Maritimes, Ontario, Quebec and B.C., though the latter three can attribute their meteoric gains to Toronto, Montreal and Vancouver. More specifically, they can credit the suburban areas surrounding these three major urban centres.

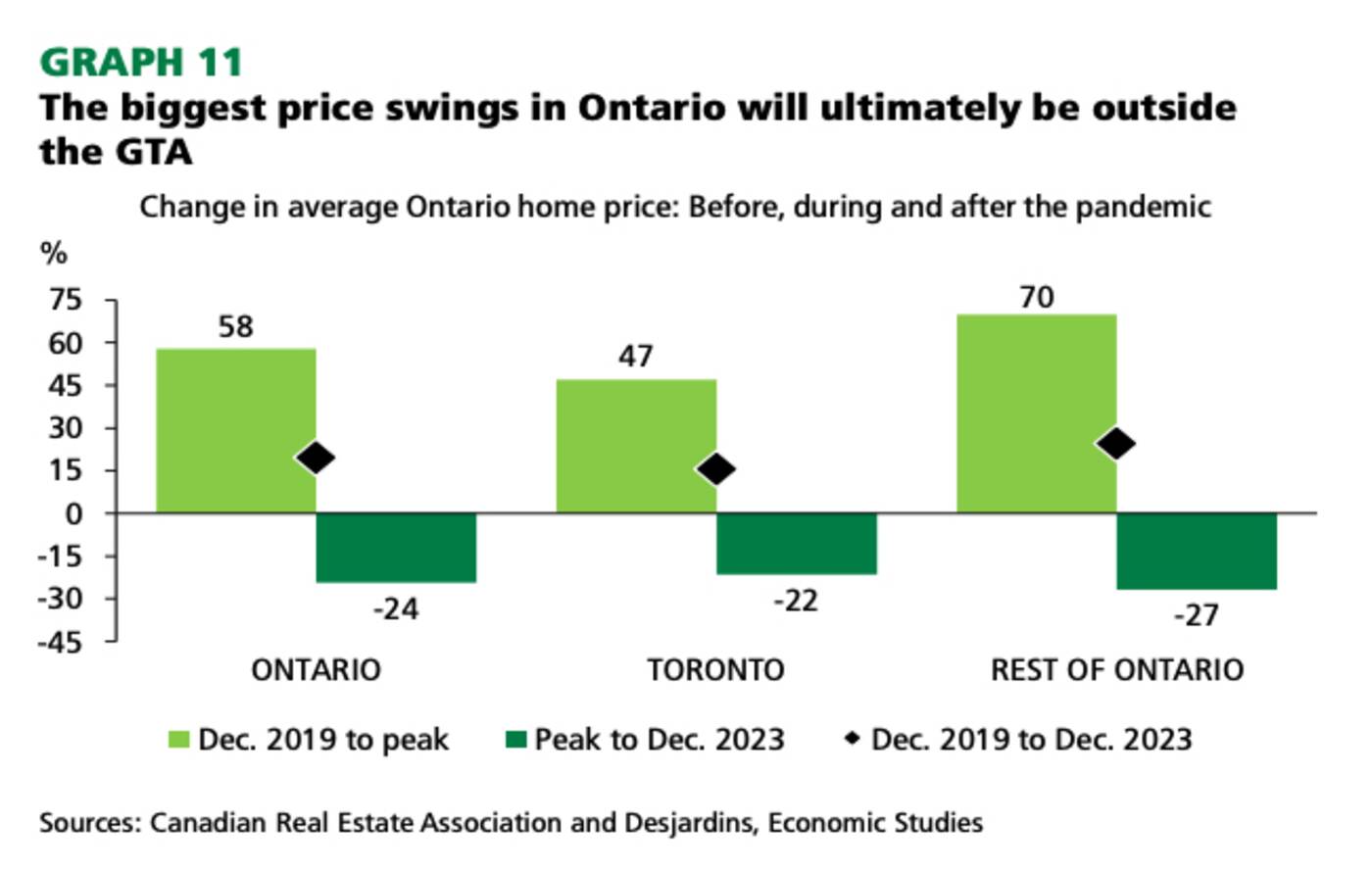

Home prices are already dropping the fastest in regions like the 905, where values skyrocketed during the pandemic. Image via Desjardins.

Commodity-producing provinces should fare better than most, according to the report's authors, "as resource prices are set to fall further but remain above pre-COVID levels."

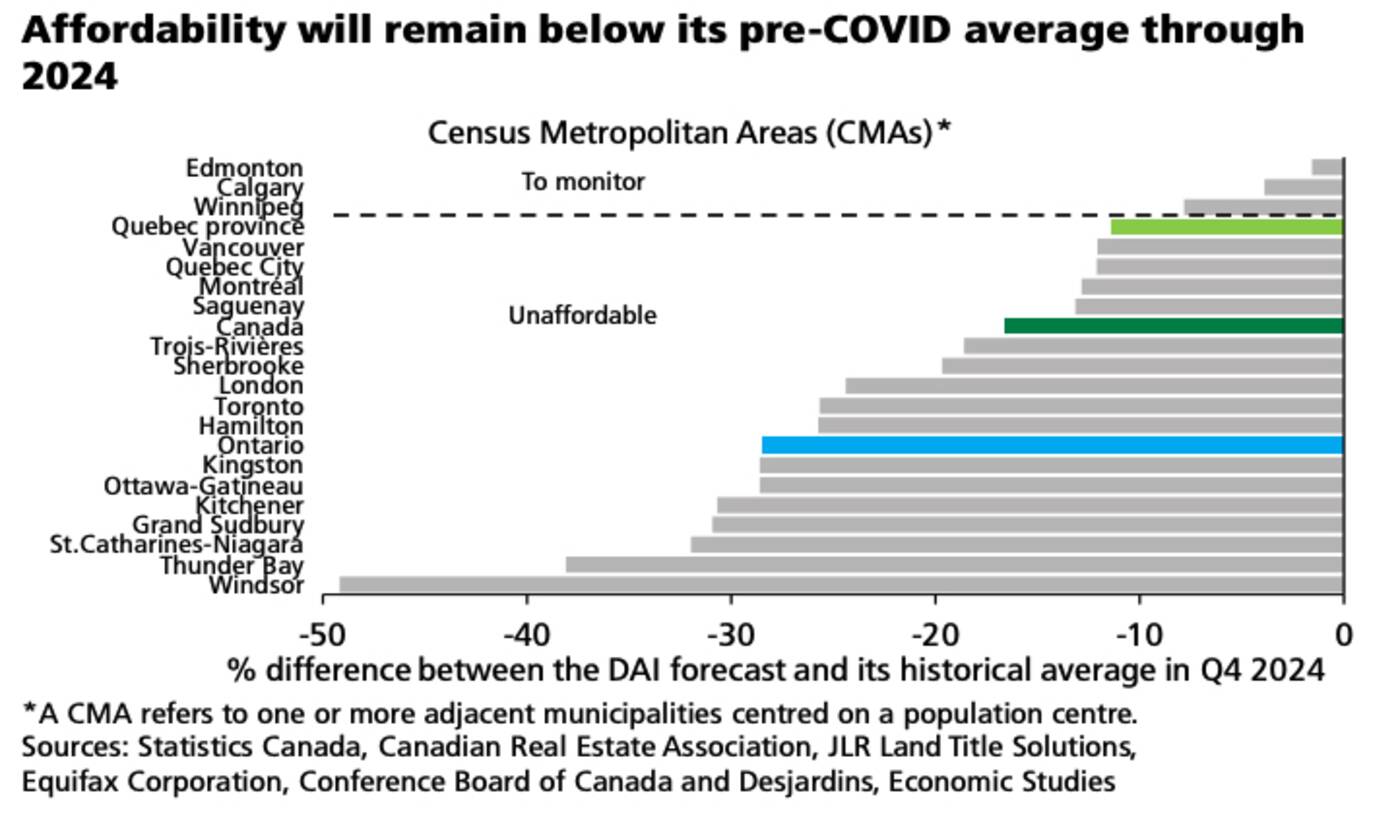

On the whole, affordability is expected to improve across the country, with Winnipeg, Edmondon and Calgary posting the strongest improvements (much to the delight of Alberta Premier Jason Kenney, I'm sure.)

"Affordability is slated to gradually improve in Ontario and Quebec but remain well below pre-COVID levels through the end of 2024," say the economists.

Will things get better in Canada's largest province? Perhaps, compared to right now. But there's still a long way to go.

Affordability is poised to improve for many Canadians year-over-year, but not enough to put cities like Toronto anywhere near the criteria for being labelled 'affordable.' Image via Desjardins.

"Until recently, Ontario led the national decline in existing home sales. While experiencing some reprieve in August, transactions were still down 37% from their February 2022 peak," reads the report.

"But the recent improvement in Ontario's existing home market isn't expected to last. Highly indebted households in the province are particularly vulnerable to rising interest rates."

Desjardins notes that it was communities surrounding the Greater Toronto Area (GTA), as opposed to Toronto itself, that saw the largest pandemic-induced spike in sales and prices.

"Affordability has eroded more than elsewhere in the province and, in some cases, the country," said the analysts of 905 markets.

"What's more, employees returned to work in September 2022 with a fervour not seen since the start of the pandemic. Indeed, life in general seems to be getting back to normal. In all likelihood then, the prospects for sustained sales and price support in communities outside the GTA should continue to fade over the outlook."

Latest Videos

Latest Videos

Join the conversation Load comments