These small towns have the fastest-declining home prices in Ontario

Property values are starting to tank in some of the small Ontario towns that saw home prices rise to record highs in 2021, when legions of condo-dwellers were fleeing Toronto for larger, cheaper digs from which they could both live and work remotely.

A new housing market outlook from Desjardins Economic Studies suggests that home prices will continue to fall across Ontario as a whole before eventually bottoming out in the second half of 2023, but that some regions will see sharper declines than others.

"Ontario has posted the biggest decline in prices of any province since the market peaked nationally in February 2022," reads the report, which was authored by Desjardins' Senior Director of Canadian Economics, Randall Bartlett, and Principal Economist, Marc Desormeaux.

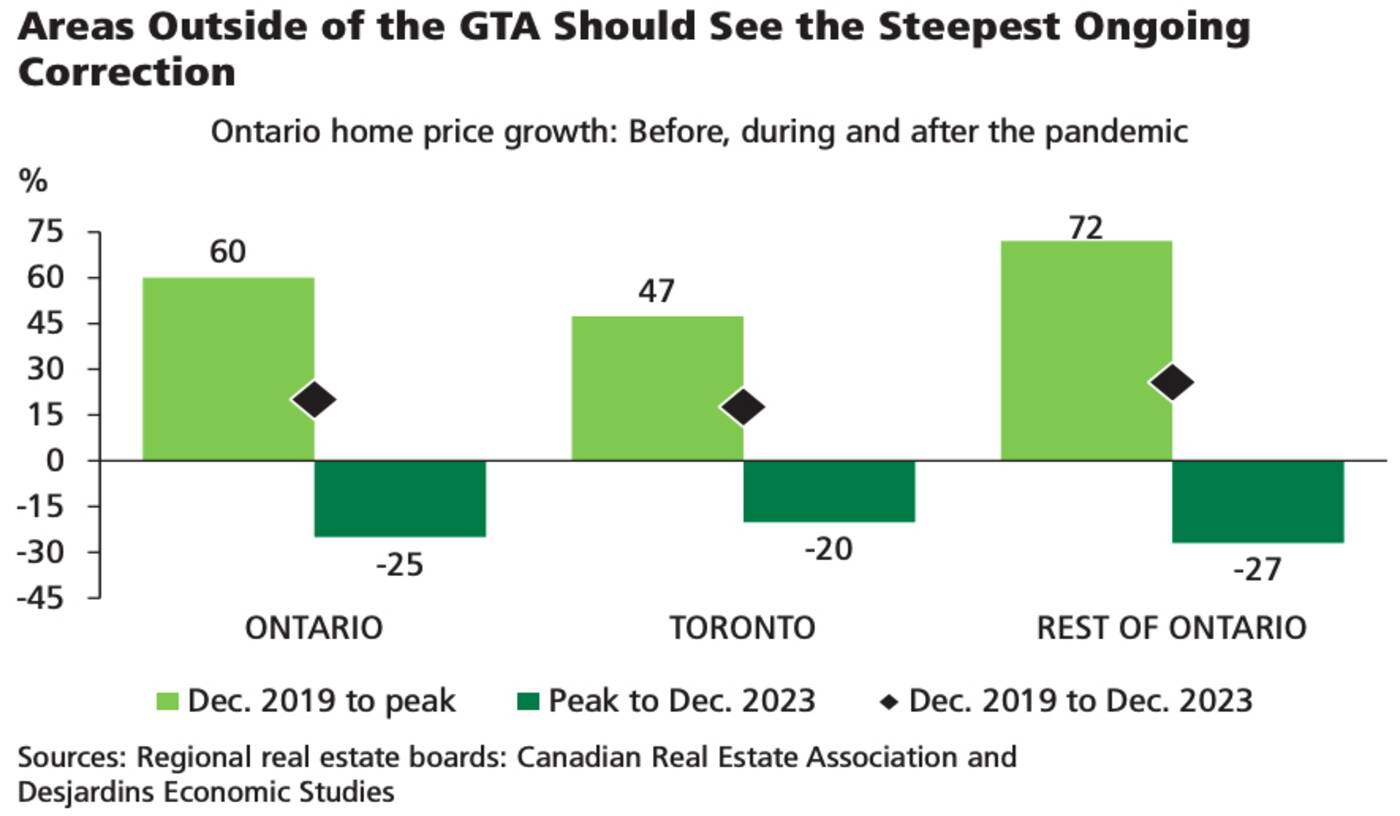

"Given nearly half of existing home sales take place in the Greater Toronto Area (GTA), that market tends to garner the most attention. But during the pandemic, it was surrounding communities that grabbed more of the headlines," the report continues.

"Home prices rose significantly in the GTA, but not nearly as much as they did in smaller Ontario communities or nationally for that matter. And these places are expected to continue seeing the biggest correction."

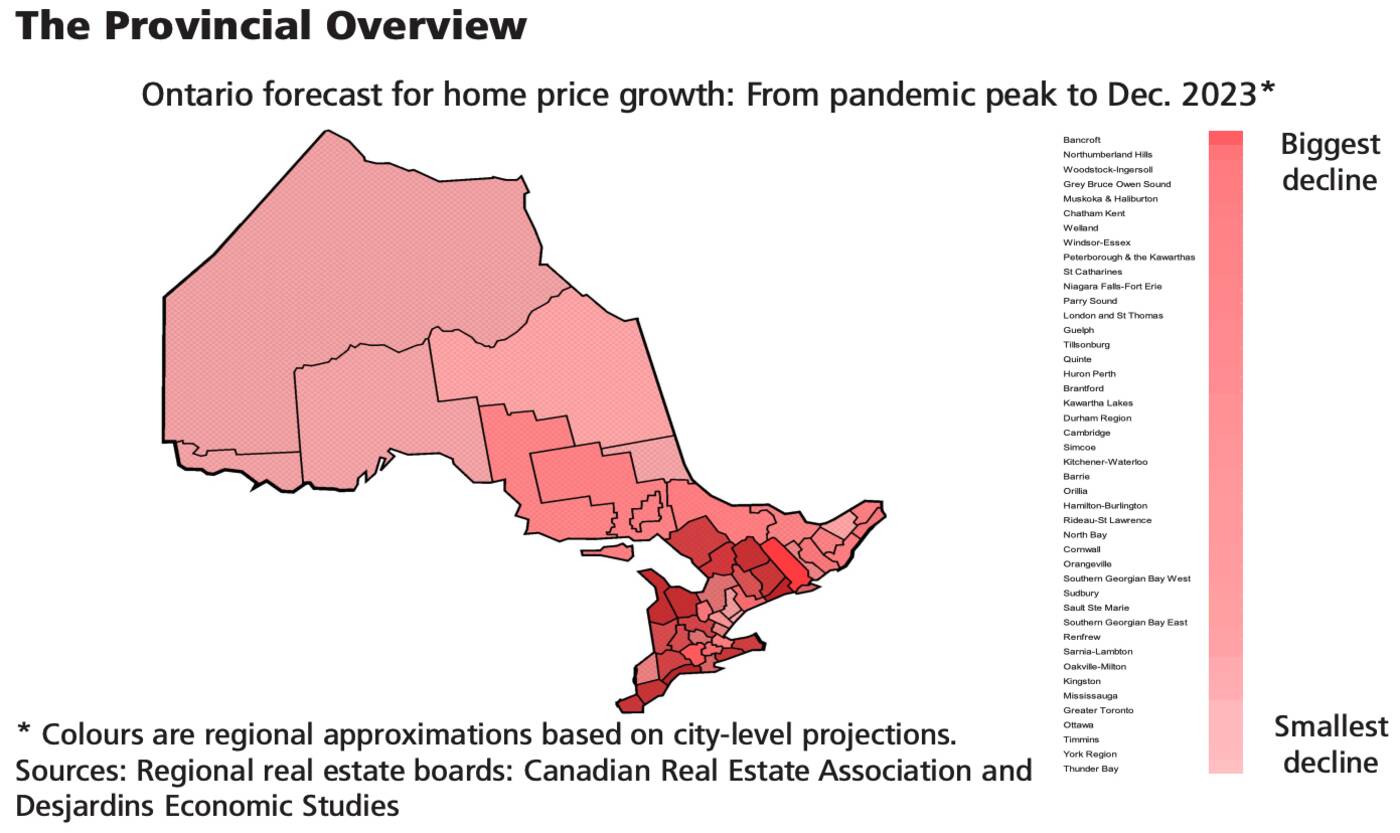

One of several graphics included in the report forecasts how much home prices are expected to decline by the end of this year from the pandemic peak.

Ontario has posted the biggest home price declines of any province since the market peaked in Canada last February. Image via Desjardins Economic Studies.

Bancroft, Ontario, which famously saw home prices nearly double amid the public health crisis and was named the best place to buy real estate in Canada during July of 2021, came out as the biggest expected loser.

The small community, roughly 2.5 hours from Toronto, was followed on the list of biggest expected price declines by Northumberland Hills, Woodstock-Ingersoll, Grey Bryce Owen Sound, Muskoka & Haliburton, Chatham-Kent, Welland, Windsor-Essex, Peterborough & The Kawarthas and St. Catharines.

"The desire for more space when working and educating children from home pushed Ontarians further afield. This unprecedented demand drove up house prices as well," reads the Desjardins report.

"Price increases in Ontario during the pandemic were most pronounced within a few hundred kilometres of the GTA. Of course, there were some notably outsized exceptions to this as well. Communities like Bancroft, Parry Sound, Quinte, Renfrew, Northumberland Hill, Muskoka and Haliburton, Woodstock‑Ingersoll and North Bay saw their average home price more than double from December 2019 to peak."

Now that the pandemic-driven urban exodus seems to be reversing course, those same communities that saw huge price hikes two years ago are seeing the biggest price declines — a trend that the report's authors say "is expected to hold going forward."

Communities outside the GTA are seeing steeper property value declines as the housing market "corrects" from its lockdown boom days. Image via Desjardins Economic Studies.

But it's not only people going back to work in big cities driving prices down in smaller communities, as urban centres have also been posting huge losses since the market peaked last year.

We can blame the Bank of Canada for a series of aggressive interest rate hikes in 2022 that made it harder for many first-time buyers to even get mortgages in the first place.

"In Canada as a whole, we've seen existing home sales and average prices fall sharply from their pandemic peaks. The primary catalyst for this correction was the rapid tightening of monetary policy that began in March 2022," notes the Desjardins report.

"But in recent months, the pace of the housing market correction has slowed considerably. Indeed, we expect sales to find a bottom early in the second half of 2023 and home prices to begin rising shortly thereafter."

The report's authors write that, while housing affordability has eroded all over Canada in recent years, Ontario has been the hardest hit, leading to an uptick in residents moving to other provinces.

This interprovincial migration trend would take pressure off local housing markets in theory, but analysts say this isn't happening due to high levels of international migration and net non‑permanent resident admissions.

"Affordability is still stretched everywhere, and that's unlikely to change significantly in the coming years. Accelerating population growth and easing construction activity therefore raise the stakes for policymakers to deliver on affordable housing objectives," concludes the report.

"So policymakers should take up the mantra 'location, location, location' and focus their affordability measures on overpriced markets."

Latest Videos

Latest Videos

Join the conversation Load comments