Toronto home prices have taken a nosedive but the relief could be over soon

The average Greater Toronto Area (GTA) home price has plummeted in the last year, but the relief felt by homebuyers since early 2022 may soon come to an end, according to the latest market report from the Toronto Regional Real Estate Board (TRREB).

The TRREB report for March 2023 highlights tightening market conditions across the region, and the return of increasing home prices as inventory dwindles.

A year-over-year decline in selling prices — dropping 14.6 per cent from $1,298,666 in March 2022 to $1,108,606 in March 2023 — is not quite representative of the momentum the market is regaining, as the average sale price peaked above the average list price for the first time since May 2022.

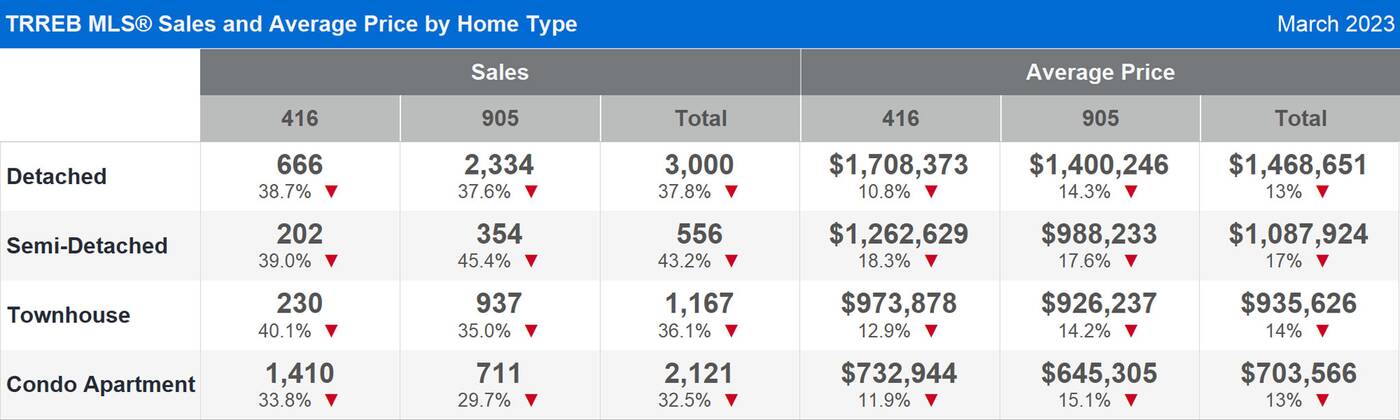

Image via Toronto Regional Real Estate Board.

The number of sales last month fell just shy of 6,900 last month, a 36.5 per cent decline from the previous March's sales figures. But once again, this year-over-year metric doesn't quite capture the current situation, as sales actually increased month-over-month from February.

Image via Toronto Regional Real Estate Board.

Compounding these factors, a continued lack of inventory plaguing the market is fostering increased competition among buyers.

"As we moved through the first quarter, TRREB Members were increasingly reporting that competition between buyers was heating up in many GTA neighbourhoods. The most recent statistics bear this out," said TRREB President Paul Baron.

"Recent consumer polling also suggests that demand for ownership housing will continue to recover this year. Look for first-time buyers to lead this recovery, as high average rents move more closely in line with the cost of ownership."

Much of the current activity can be attributed to buyers re-emerging after the Bank of Canada temporarily paused interest rates this year.

"Lower inflation and greater uncertainty in financial markets has resulted in medium-term bond yields to trend lower," said TRREB Chief Market Analyst Jason Mercer.

"This has and will continue to result in lower fixed-rate borrowing costs this year. Lower borrowing costs will help from an affordability perspective, especially as tighter market conditions exert upward pressure on selling prices in the second half of 2023," continued Mercer.

TRREB CEO John DiMichele warns that pressure on the market is set to increase, saying that "as population growth continues at a record pace on the back of immigration, first-time buying intentions will remain strong."

"Because the number of homes for sale is expected to remain low, it will also be important to have substantial rental supply available. Unfortunately, this is not something we have at the present time," says DiMichele, adding that "we need to see a policy focus on bringing more purpose-built rental units online over the next number of years."

Fareen Karim

Latest Videos

Latest Videos

Join the conversation Load comments