Here's how much you need to earn to afford a home in Toronto

Rent in Toronto continues to climb beyond what most people can reasonably afford, as the cost of living continues to soar and wages trail behind.

For some, the alternative may be investing in a property, but a new report from the National Bank of Canada sheds light on just how much you need to be making (and saving) in order to afford a home in one of Canada's most expensive cities, and needless to say, it isn't cheap.

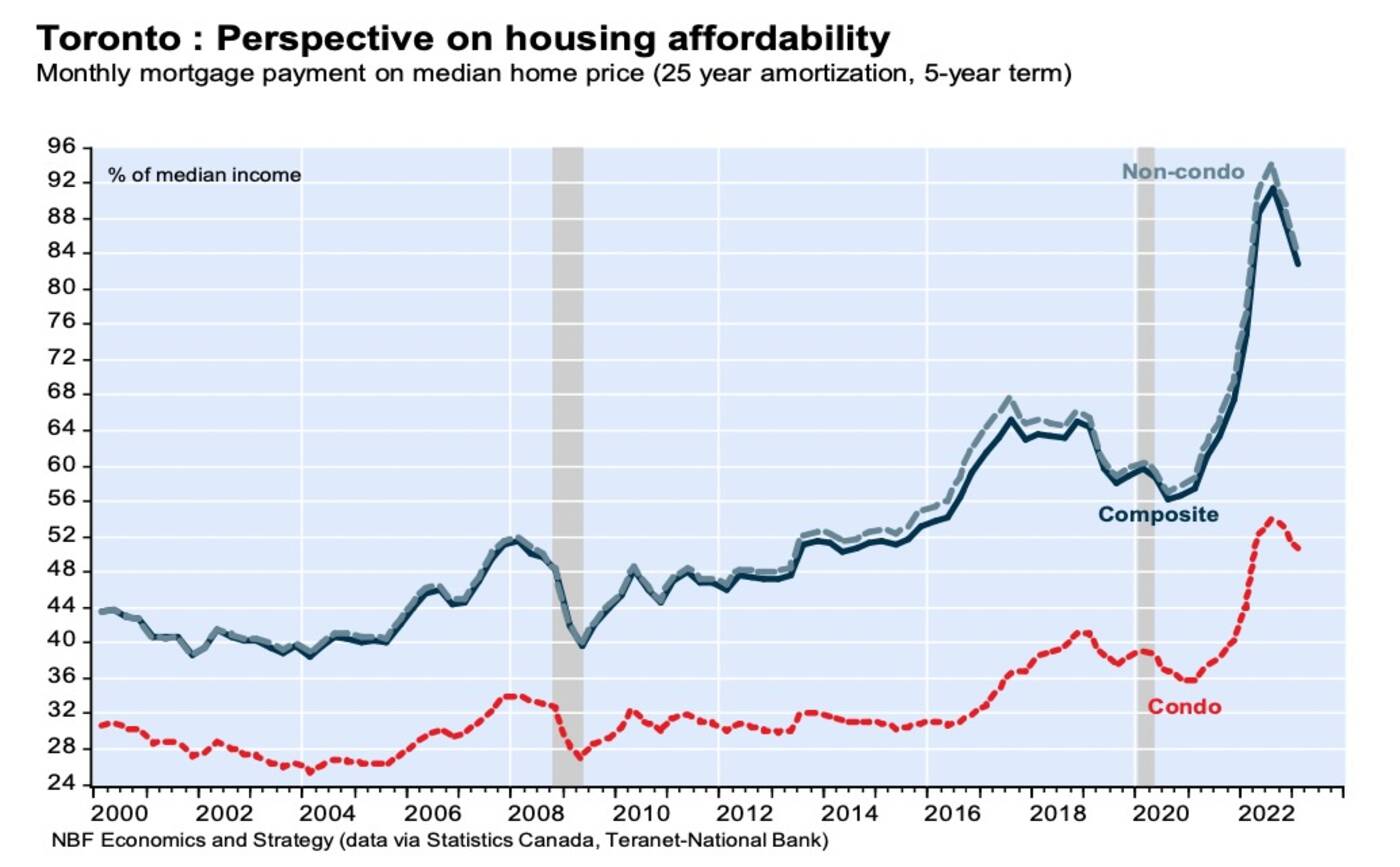

According to the report, the first quarter of 2023 in the GTA was characterized by a "second improvement in affordability" after nine consecutive quarters of deterioration.

In Toronto, you'll need a household income of approximately $165k for the average-priced condo, and $236k for your typical single-family home.

In Toronto you will need a household income of $165k for an average condo or $236k for an average SFH. If you want a SFH you will need to save up for 304 months for the down payment, a condo would be 58 months. #ToRE pic.twitter.com/zDeahtNmyg

— Justice_Queen 🏗🏙🚇⚖️ (@RE_MarketWatch) June 5, 2023

At a saving rate of 10 per cent, this means you'll need 58 months (or just shy of five years) to save for a down payment on your typical condo, and a staggering 304 months (or just over 25 years) for a down payment on a single-family home.

Source: National Bank of Canada.

In comparison, you'll need an annual household income of $159k for an average-priced condo in Hamilton, or $219k for an average-priced single-family home.

At a saving rate of 10 per cent, this means you'll need 57 months (just over four-and-a-half years) to save for a down payment on a typical condo, or 93 months (just shy of eight years) for a down payment on a single-family home.

Looking at Canada as a whole, you'll find the shortest saving time in Edmonton, where you'll just need 17 months of savings and a household income of $60,919 to afford an average-priced condo of $252,713.

A Great Capture

Latest Videos

Latest Videos

Join the conversation Load comments