Here's where you'll have the most luck nabbing a house for cheap in Ontario right now

If you live in Ontario, you're likely more concerned about being able to cover your next grocery bill than a down payment on a home right now, but for anyone still trying to keep the futile dream of property ownership alive, the cities that you'll fare best in are ever changing.

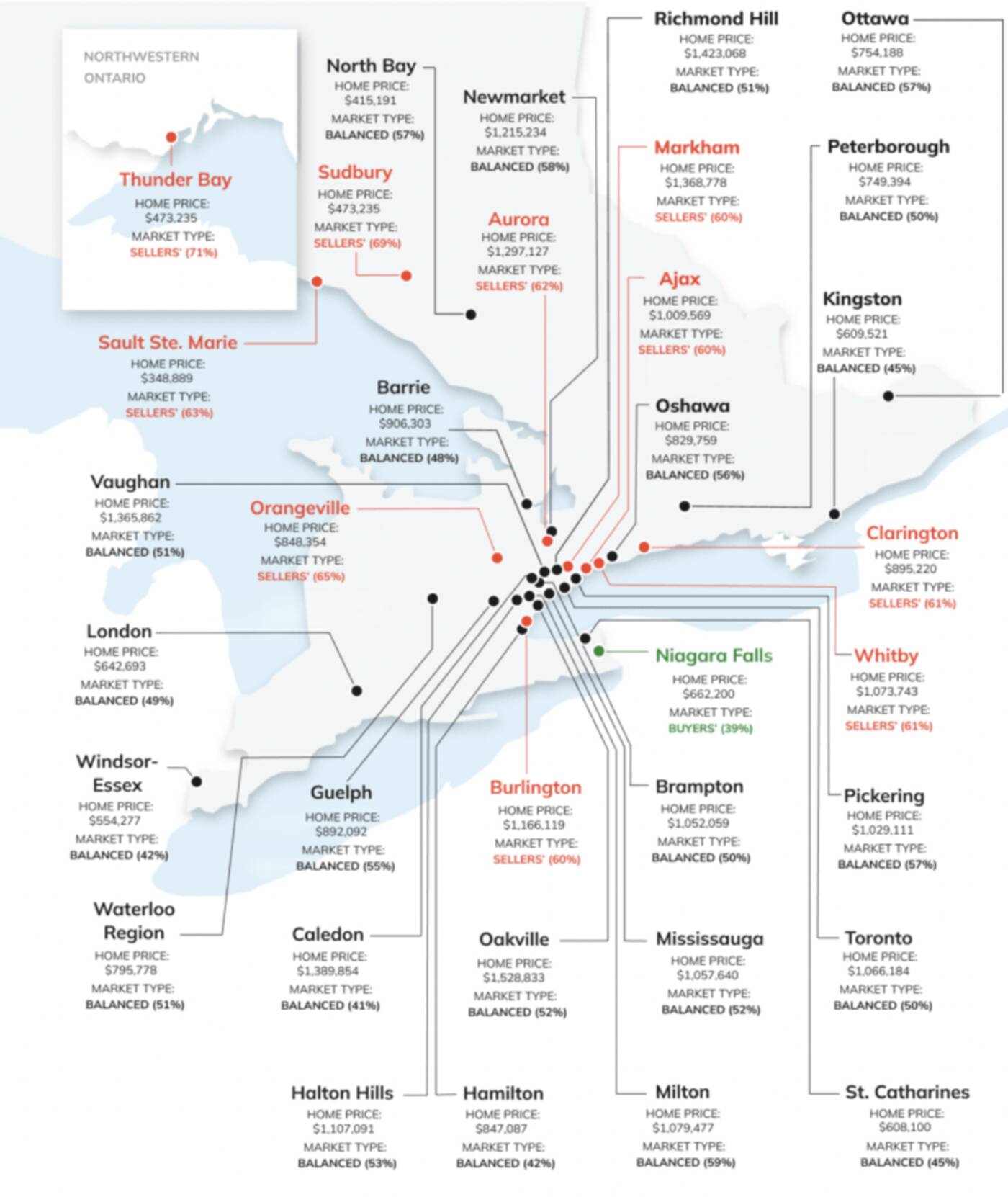

A new report from Canadian real estate listing site Zoocasa has shed some light on the present market, identifying which places in the GTA are the most favourable for would-be buyers based on July 2023 data.

For those who can brave the prohibitive interest rates, only one city out of 34 analyzed is currently considered a buyers' market, while 10 are leaning more toward sellers. And, fortunately, the city that has the best stats for those on the hunt for a home is also one of the few spots where the average cost of a place is lower than the national average right now.

Less than two hours from Toronto, prices for Niagara Falls real estate sit at around $662,200, just slightly below the $668,754 it costs to buy the typical home in Canada.

Though this isn't nearly as cheap as Sault Ste. Marie, North Bay or Thunder Bay — where average prices in July were $348,889, $415,191 and $473,235, respectively — Niagara Falls is far more ideal for buyers at the moment due to not just its proximity to the GTA, but its sales-to-new-listings ratio of 39 per cent.

This figure represents the supply and demand in any given locale, and thus the level of competition that buyers face. No other city on the list has a ratio below 41 per cent, and some, like Thunder Bay's, are as high as 71 per cent, meaning sellers very much have the upper hand and bidding wars are more common.

Toronto and surrounding cities such as Brampton, Mississauga and Pickering all have balanced markets, with ratios of 50 to 57 per cent, but far higher average prices than the rest of the country.

Toronto and surrounding cities such as Brampton, Mississauga and Pickering all have balanced markets, with ratios of 50 to 57 per cent, but far higher average prices than the rest of the country.

The average home price in Toronto, per Zoocasa numbers, was $1,066,184 in July; less than 11 other cities, four of which are sellers' markets, no less. Currently, Oakville, Richmond Hill, Caledon, Markham, and Vaughan are the most expensive places to buy in the province based on the mean price last month.

Zoocasa adds that the slow pace of sales this summer, largely due to increased costs of living and inflated mortgage rates, have led many markets to balance out in this manner. But, inventory remains tight as the pressure to build more units amid the current housing crisis and record-high immigration remains strong.

"After two interest rate hikes this summer, housing price growth has slowed across Canada. Supply is rebuilding as sales have slowed, meaning prospective buyers could soon reap the benefits of the increased inventory," this latest report reads.

"While markets could become more favourable for potential buyers in the future, only one Ontario market favours those looking for a home right now."

Royal LePage NRC Realty via Zoocasa

Latest Videos

Latest Videos

Join the conversation Load comments