The average condo price in Toronto is $400K more than what most people can afford

It's no secret that affordability has dwindled drastically, with even median-income earners struggling to keep up and finding it next to impossible to cover the average condo price in Toronto.

As home prices continue to escalate across the city, wages haven't increased at the same rate. In Toronto, the average-priced home still sits above $1 million, and the average price of a condo in the downtown core will run you over $760,000.

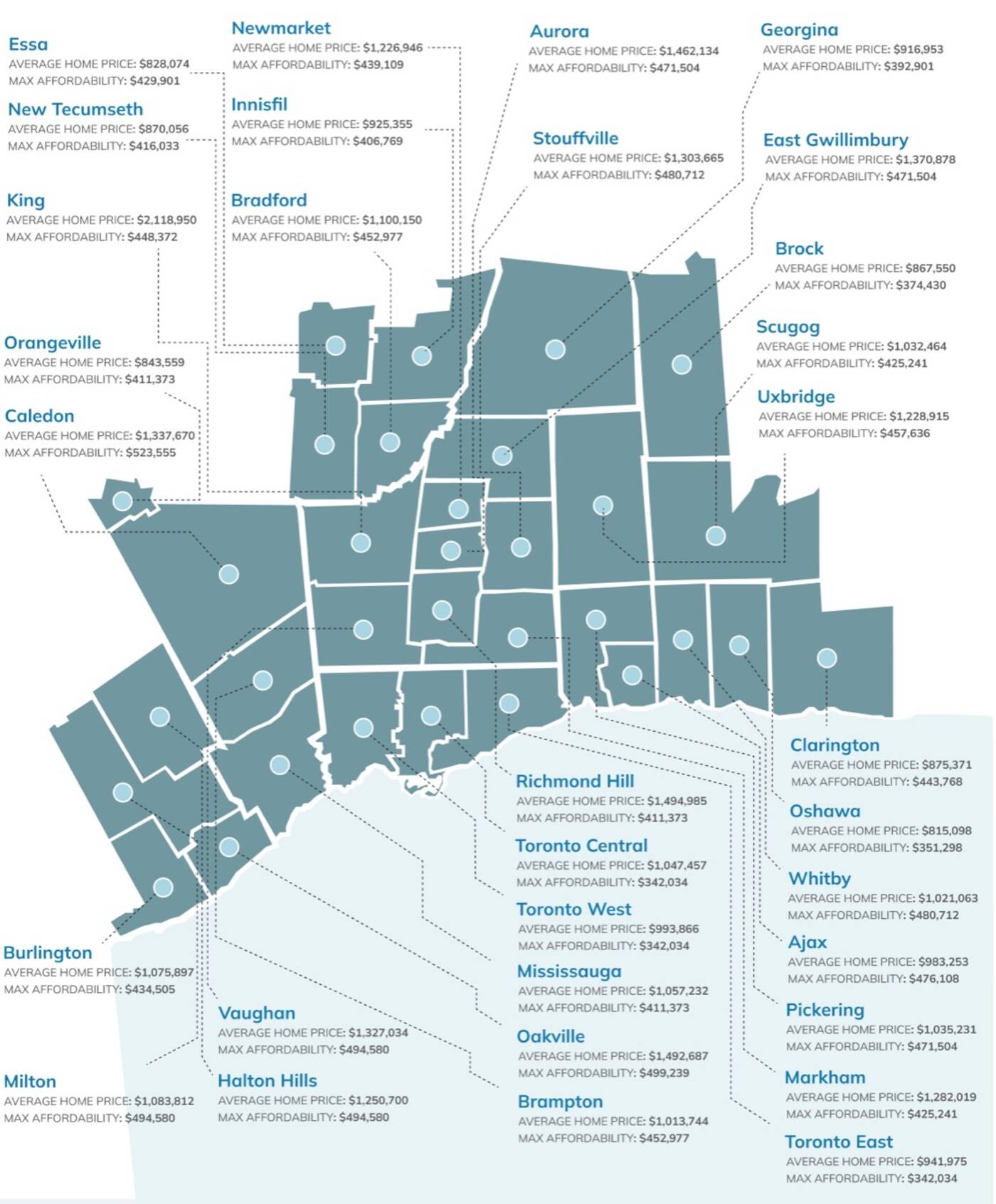

To find out what people earning the median income can afford, Zoocasa recently analyzed median incomes in major markets across the GTA, calculated the maximum affordability, and compared it to average home prices in each.

Median incomes were sourced from the most recently available census data from Statistics Canada, and maximum affordability was determined using Scotiabank's "What Can I Afford" calculator, with a 5.04 interest rate and an amortization period of 25 years.

Maximum affordability for median income earners across the GTA versus average home prices. Source: Zoocasa.

The study found that in Toronto West, Central, and East, median income earners of $74,000 can expect to afford a home priced at roughly $342,000.

In Toronto Central, the average-priced condo apartment will still cost you $760,485, representing an approximate $400,000 difference between what the median income earner can afford and what's currently available on the market.

The brokerage found that Caledon has the largest median household income in the GTA at $113,000, meaning that median-income earners can expect to afford a home of around $523,555. However, this figure is just over $800,000 shy of the average cost of a home in the city.

In the city with the second highest median income, Oakville, earners can expect to afford a home of around $499,239, which is nearly $1 million less than the average cost of a home in the city.

Even in the region's most affordable cities, median-income earners will struggle to match the price of an average condo apartment.

The most affordable city on the list is Oshawa, where the average home still costs approximately $815,098, which is hundreds of thousands of dollars above what the median-income earner can afford at $351,298.

Out of all the cities analyzed, there's only one area where median-income earners can afford to buy a property.

Those in Uxbridge earning the median income of $99,000 can afford to buy a home at the price of $457,636, which is more than required to purchase an average-priced condo at $434,500.

However, it's the only property type that median-income earners can afford to buy out of all the cities analyzed by the brokerage, painting a clear picture of just how unaffordable the region has become.

Fareen Karim

Latest Videos

Latest Videos

Join the conversation Load comments