Canada's bonkers rent prices are now the main driver of our skyrocketing cost of living

Inflation is continuing to hammer the wallets of Canadians as our lengthy cost of living crisis wages on, but it is no longer gas and grocery prices causing the most damage.

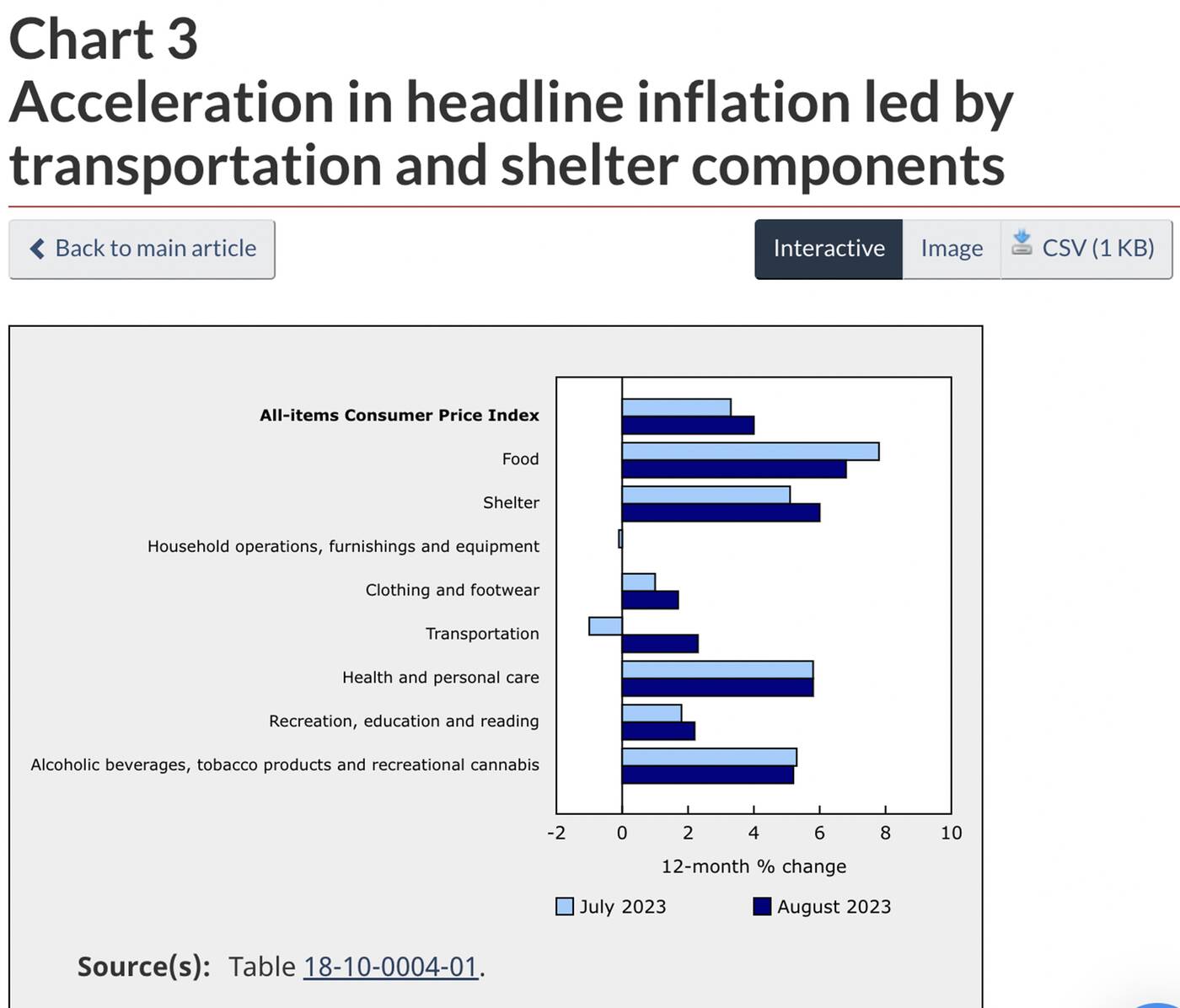

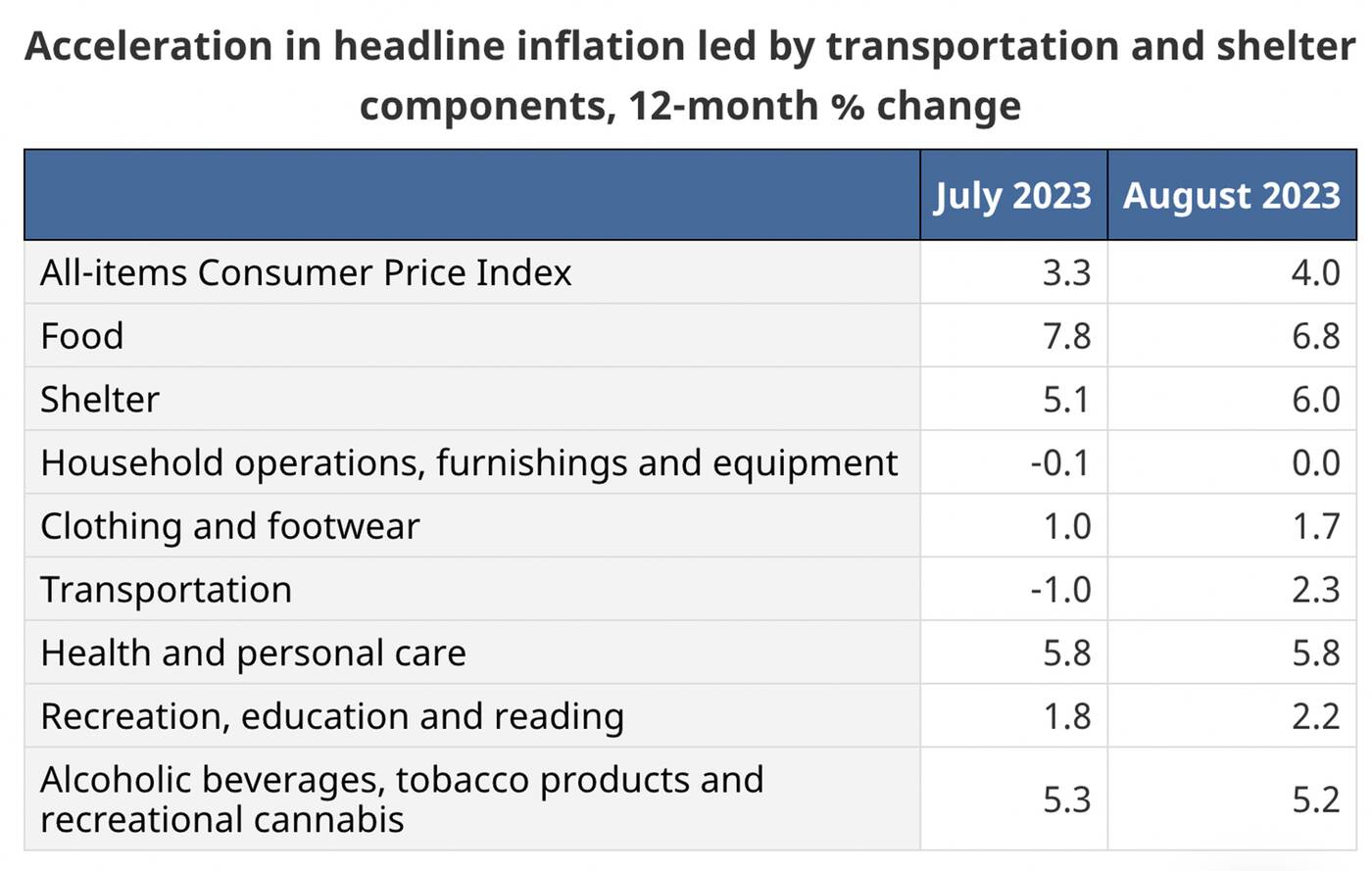

According to the latest Consumer Price Index from Statistics Canada, the four per cent increase in the cost of consumer goods this August versus last is led by higher energy prices, and also higher rent and mortgage payments.

Out of all the categories of goods and services measured, the jump in what people have to pay for shelter is the most significant year-over-year, along with transportation costs due to the fact that gas saw its first yearly increase since January (a relatively meagre 0.8 per cent).

The amount that people coast to coast are dishing out for rent and mortgage bills, though, has soared six per cent from this time last year, which is 0.9 per cent higher than July's y-o-y spike.

Tenants are being impacted the most, with StatCan saying that "faster growth in shelter prices was led by the rent index, which rose 6.5 per cent year over year nationally after a 5.5 per cent gain in July. Among other factors, a higher interest rate environment, which may create barriers to homeownership, put upward pressure on the index."

Tenants are being impacted the most, with StatCan saying that "faster growth in shelter prices was led by the rent index, which rose 6.5 per cent year over year nationally after a 5.5 per cent gain in July. Among other factors, a higher interest rate environment, which may create barriers to homeownership, put upward pressure on the index."

While rent hikes are accelerating at a faster rate month-over-month than mortgage increases, mortgage interest costs are up a shocking 30.9 per cent as of August (compared with 30.6 per cent in July).

The report also notes that grocery prices remain extremely high, despite grocery inflation slowing — food was 6.9 per cent more expensive this August versus August 2022, compared with 8.5 per cent more pricey this July versus July 2022 — led by beef (up 11.9 per cent y-o-y), sugar and sweets (up 10.9 per cent), and coffee and tea (up nine per cent).

The report also notes that grocery prices remain extremely high, despite grocery inflation slowing — food was 6.9 per cent more expensive this August versus August 2022, compared with 8.5 per cent more pricey this July versus July 2022 — led by beef (up 11.9 per cent y-o-y), sugar and sweets (up 10.9 per cent), and coffee and tea (up nine per cent).

Food remains the most-inflated item compared to this time last year, despite not having the fastest-rising prices compared to last month.

Unfortunately, prices overall rose at a faster pace in August compared with July in every single province, but was the worst in Newfoundland and Labrador (+ 8.4 per cent), Nova Scotia (+ 9.5 per cent) and Manitoba (+ 6.1 per cent), which appear to be catching up to the sticker shock we notoriously experience for basically everything in Ontario and B.C.

Aimhome Realty Inc., Brokerage via Strata.ca

Latest Videos

Latest Videos

Join the conversation Load comments