Here's how long you need to save up to buy a condo in Toronto

Preparing to purchase your first condo in Toronto can be an incredibly stressful experience (to say the very least), given all the uncertainties that come with the city's real estate market through increased competition and rising costs.

According to the Toronto Regional Real Estate Board (TRREB), the average one-bedroom condo apartment rent in Q2 2023 was a staggering $2,532, representing an 11.6 per cent increase from Q2 2022.

Given Toronto's constantly soaring rent prices, you might be tempted to invest in the long haul instead and save up to purchase your own condo apartment.

A recent study by Zoocasa analyzed how rent costs compare to those of homeownership, by comparing average condo apartment lease rates with sold prices for condos in 35 neighbourhoods across Toronto.

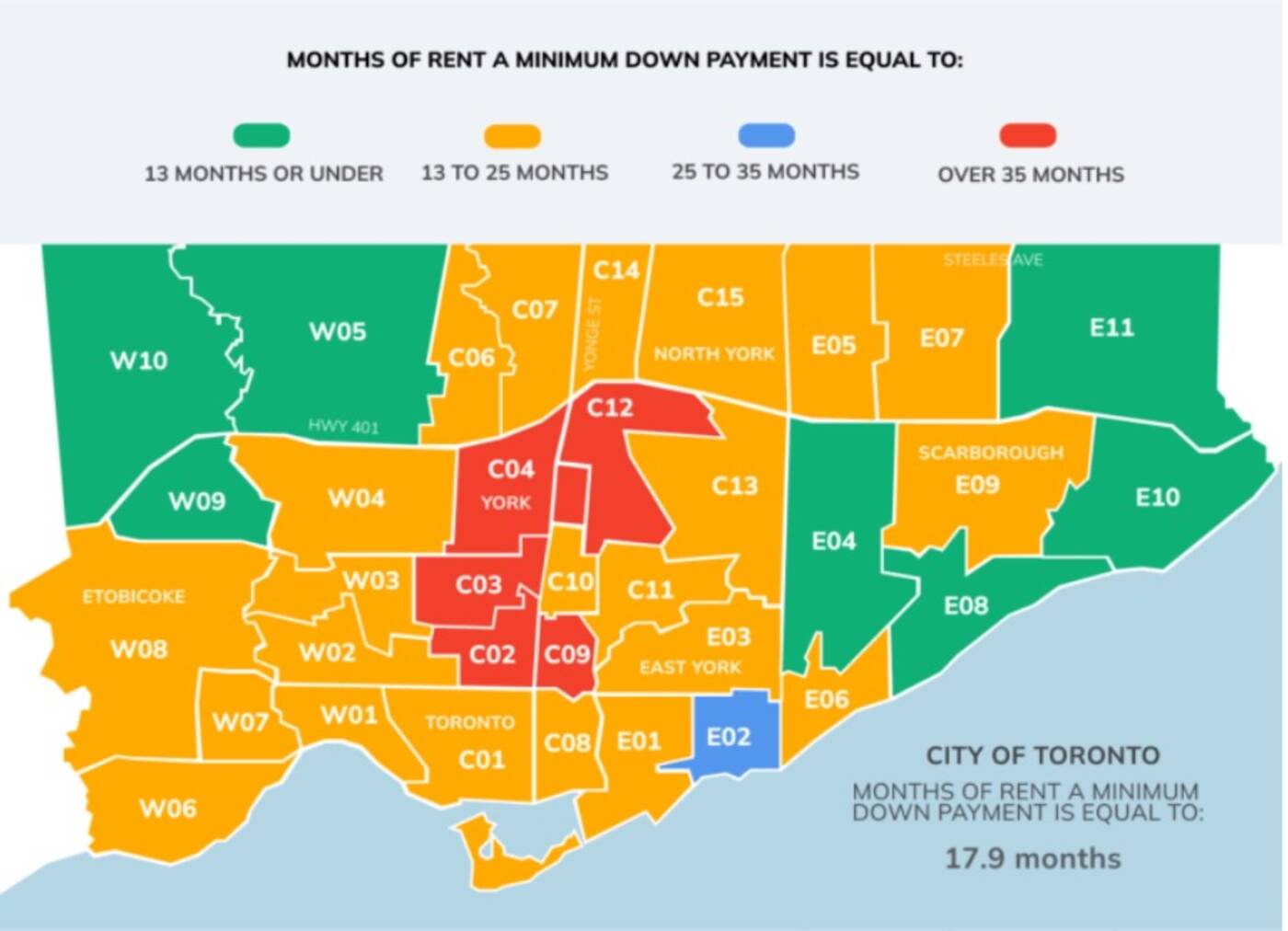

Minimum saving period required to pay down payment for average-priced condo across neighbourhoods in Toronto. Source: Zoocasa.

The Canadian brokerage then calculated the minimum down payment required in each neighbourhood and found out how many months of rent the minimum down payment is equal to. Average lease rates and sold prices for Q2 2023 were sourced from the TRREB.

For the purposes of this study, the number of months of rent needed for the minimum down payment was determined by assuming that the renter does not pay rent during the saving period.

The last time Zoocasa conducted this study was in March 2023 using Q4 2022 data, and since then, several neighbourhoods have become more affordable, while others have soared in both rent and sold prices.

Some neighbourhoods where it would take less time to save for a condo down payment now than in Q4 2022 include Willowridge-Martingrove-Richview, Islington-City Centre West, Eringate-Centennial-West Deane, East York, Danforth Village, Leslieville, Riverside, and Little India.

According to the study, for the City of Toronto as a whole, it would take an average renter 17.9 months to come up with the $51,983 down payment necessary to purchase the average condo apartment priced at $769,832.

Breakdown of saving period required to pay minimum down payment for average-priced condo apartments across neighbourhoods in Toronto. Source: Zoocasa.

While the average price of a condo in the city has increased in the last two quarters, the average condo lease rate has also increased by over $100.

The brokerage found that the neighbourhood where it would take the least amount of time to save is West Hill, Centennial Scarborough, where it would take the average renter 9.5 months to save for the minimum downpayment of $23,333 for an average condo apartment priced at $466,667.

In neighbourhoods like Stonegate-Queensway, Regent Park, St. James Town, Corktown, Mimico, Alderwood, High Park North, Junction, and Runnymede, it would take roughly 18 months to save up for the minimum down payment for an average condo apartment.

The neighbourhoods with the longest required saving periods are York Mills, Bridle Path, and Hoggs Hollow, where the average renter would need to save for a whopping 93.3 months to afford the $314,554 down payment required for the average $1,572,772 condo apartment.

While all the calculations are subject to change as the months go by, the study does highlight just how unaffordable housing in Toronto has become.

Latest Videos

Latest Videos

Join the conversation Load comments