The average price of a Toronto home just fell by over $22k in a single month

People may not know what to expect of Toronto's housing market in the next year in light of conflicting outlooks from experts, but those hoping for greater affordability may find some encouragement in the fact that interest rates appear to be having more of an effect on prices lately.

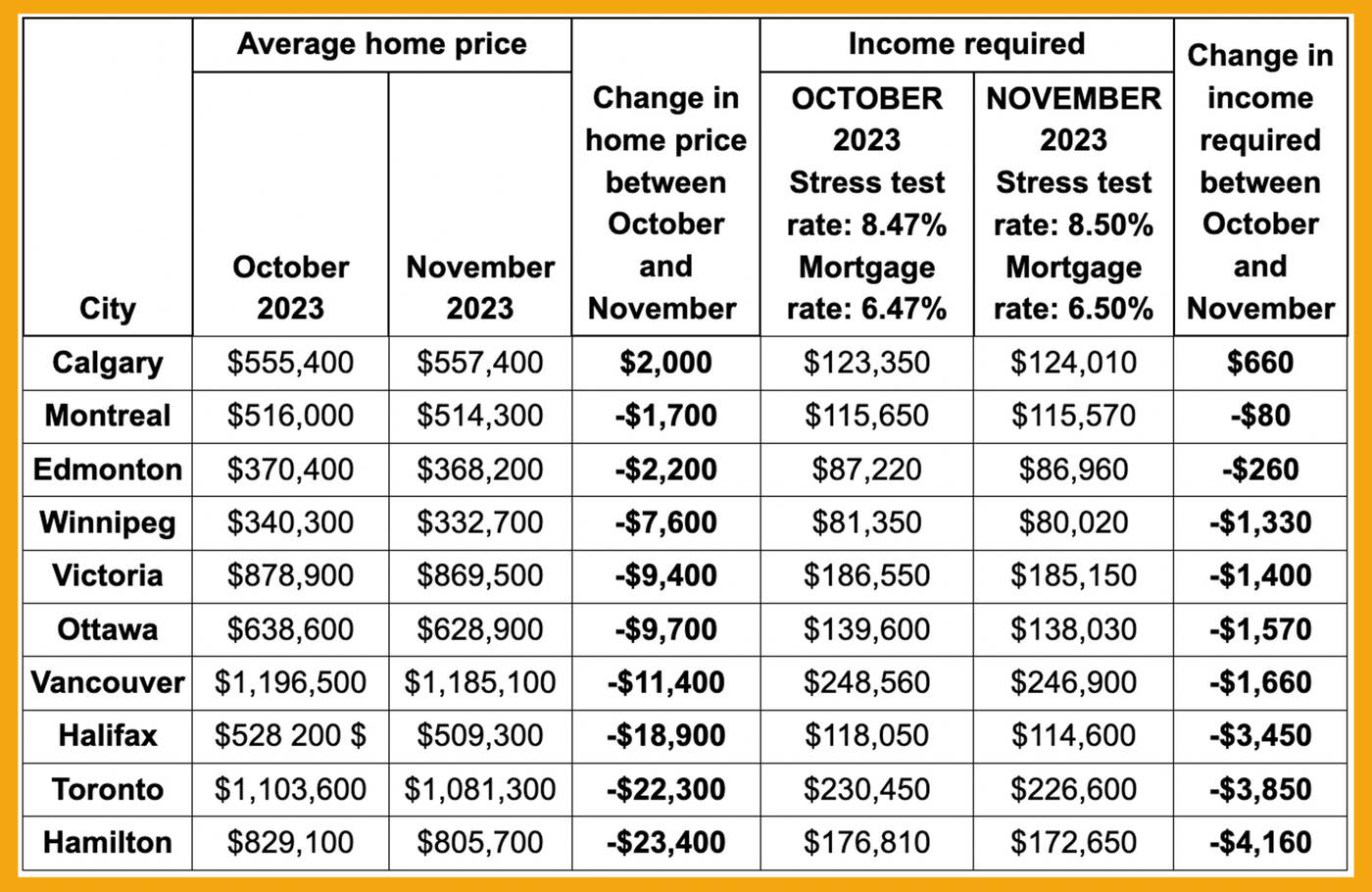

A new study on the amount of income needed to buy a home in major cities nationwide shows that prices have come down month-over-month in Canada's biggest metropolis, moreso than almost anywhere else in the country when looking at the dollar amount.

Here's where experts predict housing prices in Ontario will drop the most in the New Year🤔 https://t.co/2XUJTHK3z3 #Ontario #OntarioHousing

— blogTO (@blogTO) December 13, 2023

Based on the October and November 2023 numbers crunched by Ratehub.ca, the average price of a spot in Toronto fell $22,300 from one month to the next. This is compared to somewhere like Calgary, where the mean home price did the opposite, escalating $2,000 in the same period.

The mortgage brokerage says the income required to purchase a home here has thus likewise declined — by $3,850 at current rates.

"Affordability improved for the second month in a row due to home values dropping and mortgage rates holding steady in November," the firm wrote of the Canadian market overall in a release on Monday.

"Home values and the income required to purchase a home decreased in nine out of the 10 cities we looked at... [and] we expect this trend to continue in December with rates and home values dropping."

Per the report, Hamilton real estate saw the greatest improvement in affordability of all areas surveyed, with the average home plummeting $23,400 in just one month, from $829,100 to $805,700. The income needed to buy a home in that centre went from $176,810 in October to $172,650 in November, a reduction of $4,160.

Chart outlining how the average home price, and thus the income needed to buy one, changed in various Canadian cities last month from the prior month.

While Toronto home prices (and the income needed to buy one) declined the second-most of any locale on the list, we are still the second-most expensive city after only Vancouver, with an average price of $1,081,300 as of November compared to $1,103,600 in October.

The salary required to nab the typical house or condo here is now $226,600 versus $230,450 in October.

Here's what $400k can get you in Toronto real estate vs. other Ontario cities 🏙️ https://t.co/zRj8b2px0E #Toronto #Ontario #RealEstate

— blogTO (@blogTO) December 13, 2023

Though these are lower than Vancouver's stats of $1,185,100 for a home and $246,900 for the annual earnings needed to buy one, Toronto's market is still substantially more exorbitant than the rest of the country.

Home prices in Montreal, Halifax, Calgary, or even Ottawa are far more attractive, now at an average of $514,300, $509,300, $557,400 and $628,900, respectively, all down from October.

In places like Winnipeg and Edmonton, prices are still low enough that one can make under $100k per year to afford the average home, which is sadly not the case for any other city on the list.

Ratehub.ca's figures are based on the Canadian Real Estate Association's MLS Home Price Index and current big five bank lending rates with a 20 per cent down payment and 25-year amortization rate. Annual property tax bills of $4,000 and monthly heating bills of $150 were also considered.

RE/MAX Premier Inc., Brokerage via Strata.ca

Latest Videos

Latest Videos

Join the conversation Load comments