Here's how much you actually need to earn per year to afford a house in Toronto right now

Last year was a wild one for real estate in Toronto and across Canada, with steep declines in activity that somehow failed to push prices all that much lower from the highs our housing market is known for.

In fact, with high interest rates, homes got far less affordable across the country over the course of 2023, even in areas where the average price reduced somewhat due to desperate sellers and startlingly low sales numbers.

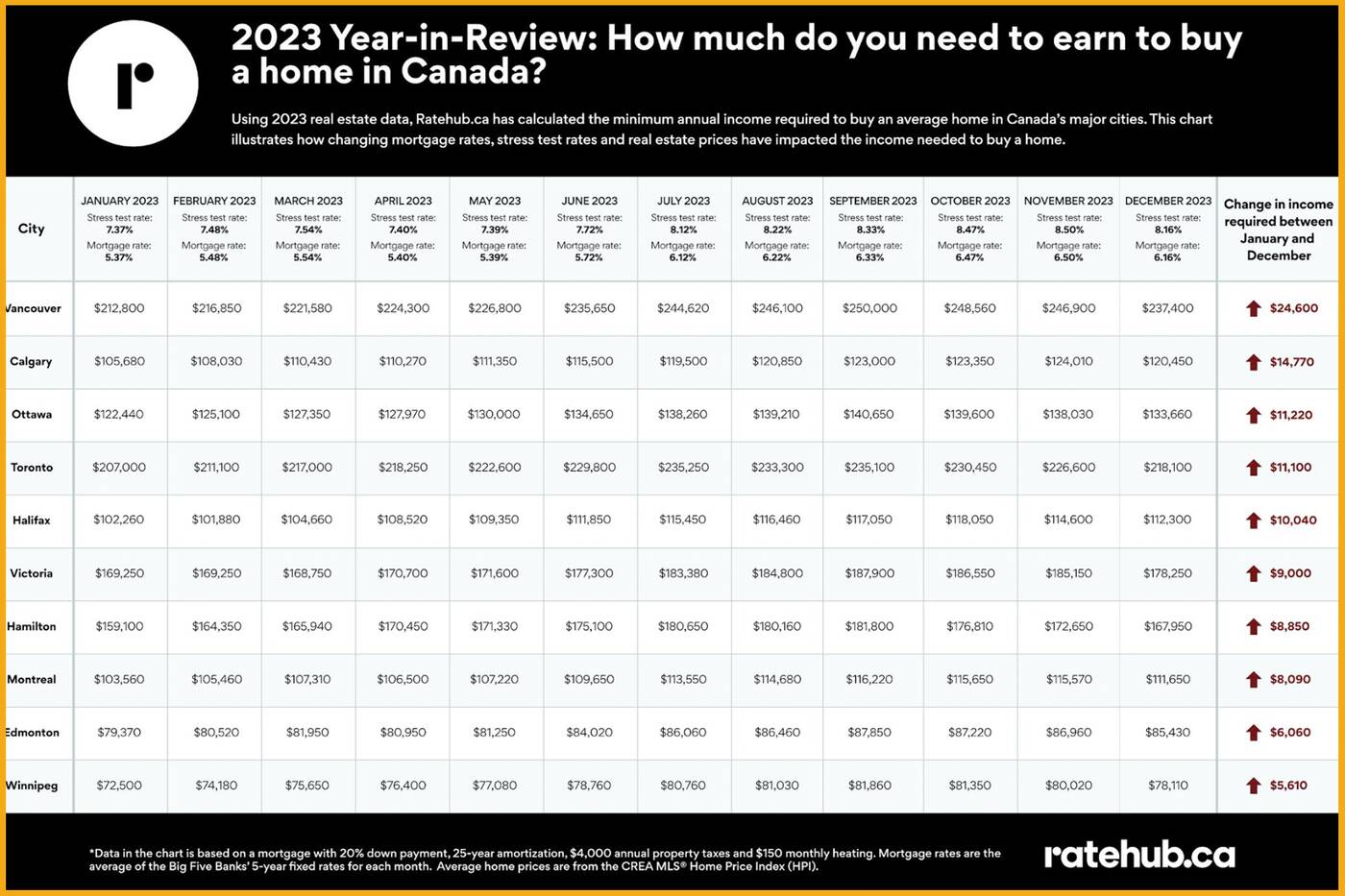

New insights from Ratehub.ca show just how much harder it has gotten to afford a house or condo in Toronto and nine other major cities across the country, with the experts calling it "a terrible year for home affordability in Canada."

"Homes were more expensive in seven out of 10 cities [and] the income required to purchase a home increased significantly in all 10 cities, ranging from an extra $5,610 in Winnipeg all the way up to an additional $24,600 in Vancouver," they continue.

The change was, of course, thanks to higher lending rates and the resulting jump in the stress test required to secure a mortgage in the first place, all of which drastically impacted affordability even if it didn't sway prices to a significant degree.

Toronto was one of three Canadian locales (along with Hamilton and Victoria, B.C.) where home values actually fell, on average, but where affordability still managed to get worse.

The cost of the typical home in T.O. plummeted $11,700 between January and December 2023, the largest price drop of any city surveyed, to hit $1,067,200. Yet, the amount of household income needed to carry the average home went up by $11,100 in the same time frame, sitting at $218,100 by the end of the year.

(Looking back to just a few years ago in early 2021, the yearly household income needed to buy a residence in Toronto was a whopping 44 per lower, at $124,335 for a condo and $178,499 for a single-family home.)

Comparatively, based on end-of-2023 data, one now needs to earn a $78,110 salary to nab a home in Winnipeg — where the standard house costs only $332,100 — $85,430 to purchase a place in Edmonton with an average home price of $370,500, $111,650 in Montreal (price: $508,300), $112,300 in Halifax ($511,600) and $120,450 in Calgary ($554,500).

On the other end of the spectrum, you need to earn $237,400 a year to buy your own spot in Vancouver, where average prices are now $1,168,700, the aforementioned $218,100 in Toronto, $178,250 in Victoria (price: $858,100), $167,950 in Hamilton ($804,000 for a home) and $133,650 in Ottawa (price: $623,900).

These figures are based on a standard-rate mortgage and stress test in December 2023 with a 20 per cent down payment and 25-year amortization on an average-priced home. Annual property taxes of $4,000 and a monthly heating bill of $150 were also taken into account.

Spiroview Inc/Shutterstock

Latest Videos

Latest Videos

Join the conversation Load comments