Here's how long you have to save up for a condo in Toronto versus other Canadian cities

Preparing to purchase a condo can be an incredibly stressful experience for any first-time buyer, given all the uncertainties that come with Toronto's high borrowing costs, limited inventory, increased competition, and cost of living crisis.

For those dependent on a single income, the obstacle of purchasing a home can be made even more challenging, making it difficult for solo dwellers to find their place in the city's real estate market.

However, as a recent Zoocasa report notes, home prices across the country are staying relatively flat and some fixed rates are coming down, meaning there are quite a few markets in the condo segment where single buyers can make their dreams of owning a home come true.

In January 2024, the national benchmark price for a condo apartment was $526,500, which was $200,000 lower than the benchmark price of a single-family home, according to the Canadian Real Estate Association (CREA).

"This positions condo apartments as the most affordable property type and is an excellent option for first-time home buyers or single-income buyers," the report reads.

To find out which cities are the best for buying a condo with a single income, the real estate brokerage analyzed benchmark price data for condo apartments in 22 markets and calculated how many months it would take a buyer earning the after-tax average income to save for the minimum down payment.

Most and least affordable Canadian cities for buying an apartment on a single income. Source: Zoocasa.

The report assumed that the prospective homebuyer was contributing 100 per cent of their annual income to save for the minimum down payment. After-tax average incomes were sourced from Statistics Canada Income Explorer, 2021 Census, and benchmark apartment prices were sourced from the CREA.

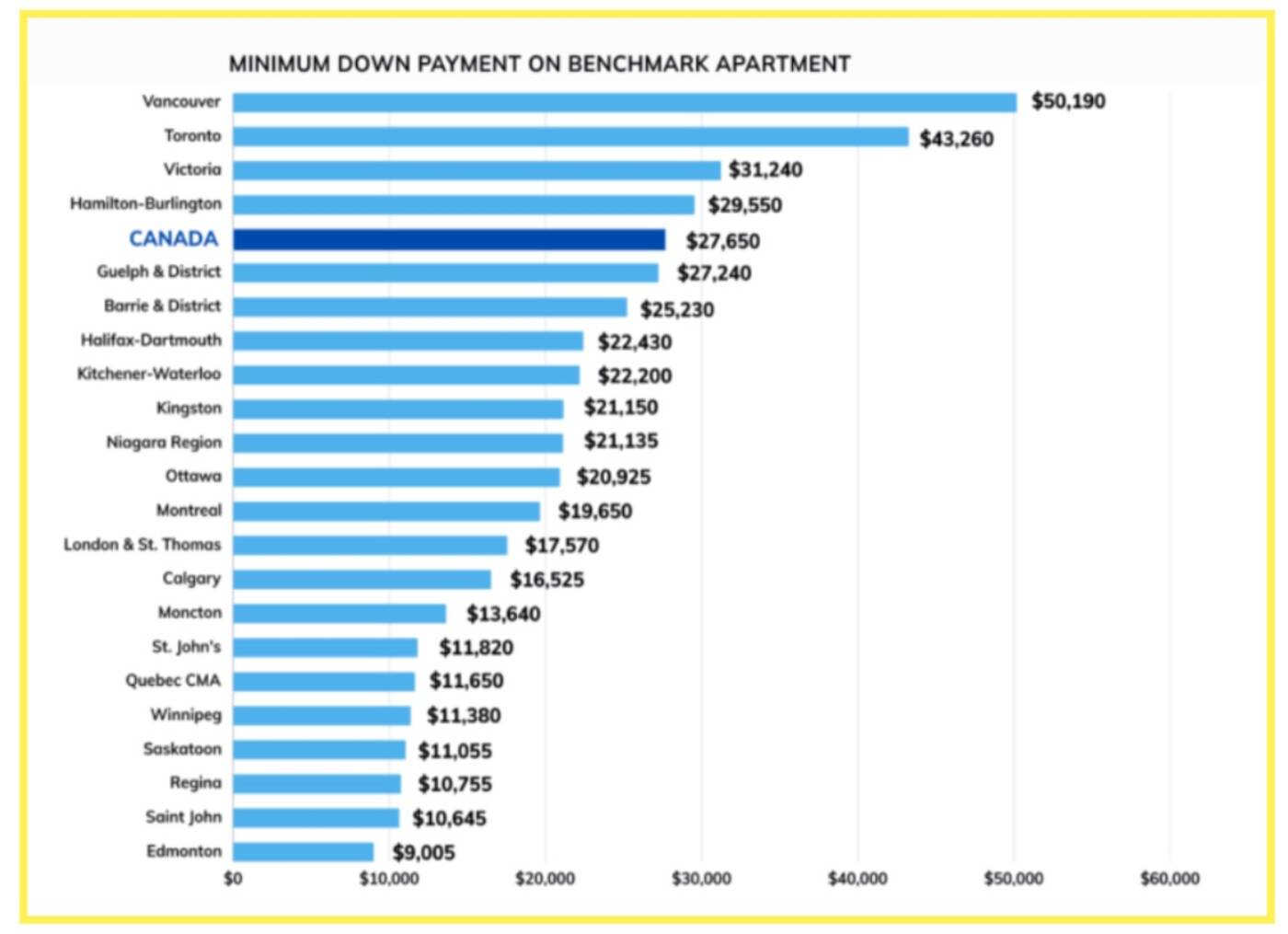

Out of all the cities analyzed, the report found that Edmonton is the most affordable city for buying a condo on a single income, requiring an average income earner 2.1 months to save up for the minimum down payment of $9,005.

In Ontario, London & St. Thomas is the most affordable place for solo buyers to purchase a condo. A prospective homeowner earning $43,560 would need to save for 4.8 months before being able to afford the required down payment of $17,570.

The minimum down payment required for the average condo in 22 Canadian cities. Source: Zoocasa.

The second most affordable area in Ontario for solo condo buyers is Ottawa, where an average income earner would need five months to save up for the benchmark condo price of $418,500.

In Toronto, the average after-tax income of those living alone is higher than Vancouver while the benchmark condo price is lower, meaning a solo buyer would need to save for 10 months to be able to afford the minimum down payment of $43,290.

Prospective condo buyers in Hamilton-Burlington also need to save up for at least seven months to be able to afford the minimum down payment of $29,550.

JulieK2/Shutterstock

Latest Videos

Latest Videos

Join the conversation Load comments