It now takes 39 years for an average person to buy a home in the GTA

The dream of owning a home in the GTA continues to move further and further out of reach for the majority of residents, but the amount of time it now takes the average person to save up for a down payment in one of Canada's most expensive regions may shock you.

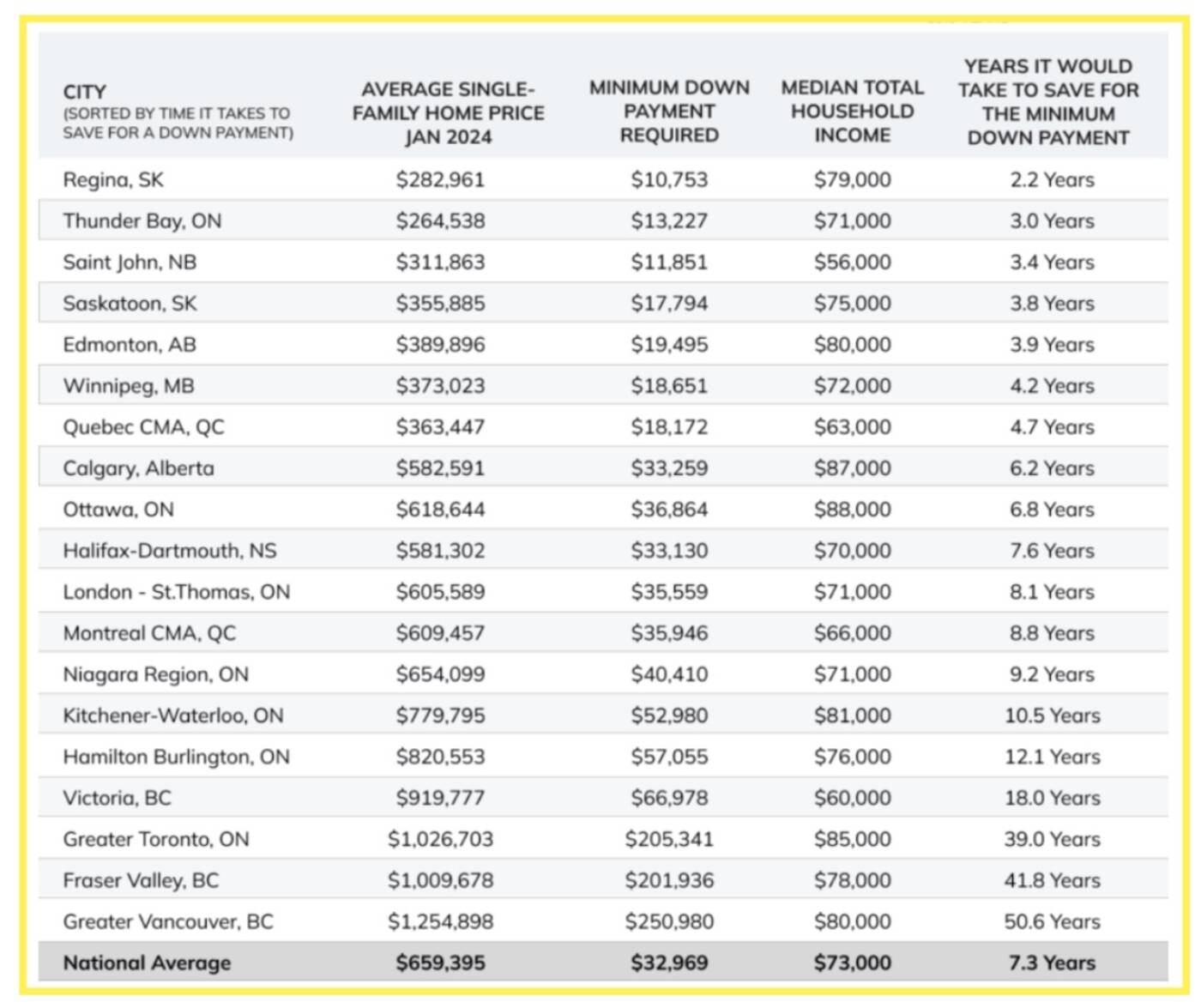

Real estate agency Zoocasa recently analyzed housing markets in 20 major cities across Canada to calculate the required down payment for each and determine how long it would take for a median, post-tax income household to save for a single-family home.

The report assumed a savings rate of 6.2 per cent of annual income using Statistics Canada's Q4 2023 household savings rate, and mortgage calculations assumed a 25-year amortization period and a fixed five-year mortgage rate of 4.84 per cent.

The study found that the average single-family home price in the GTA was $1,026,703 in January 2024, meaning it would take a household with a median total income of $85,000 exactly 39 years to save up for the minimum down payment of $205,341.

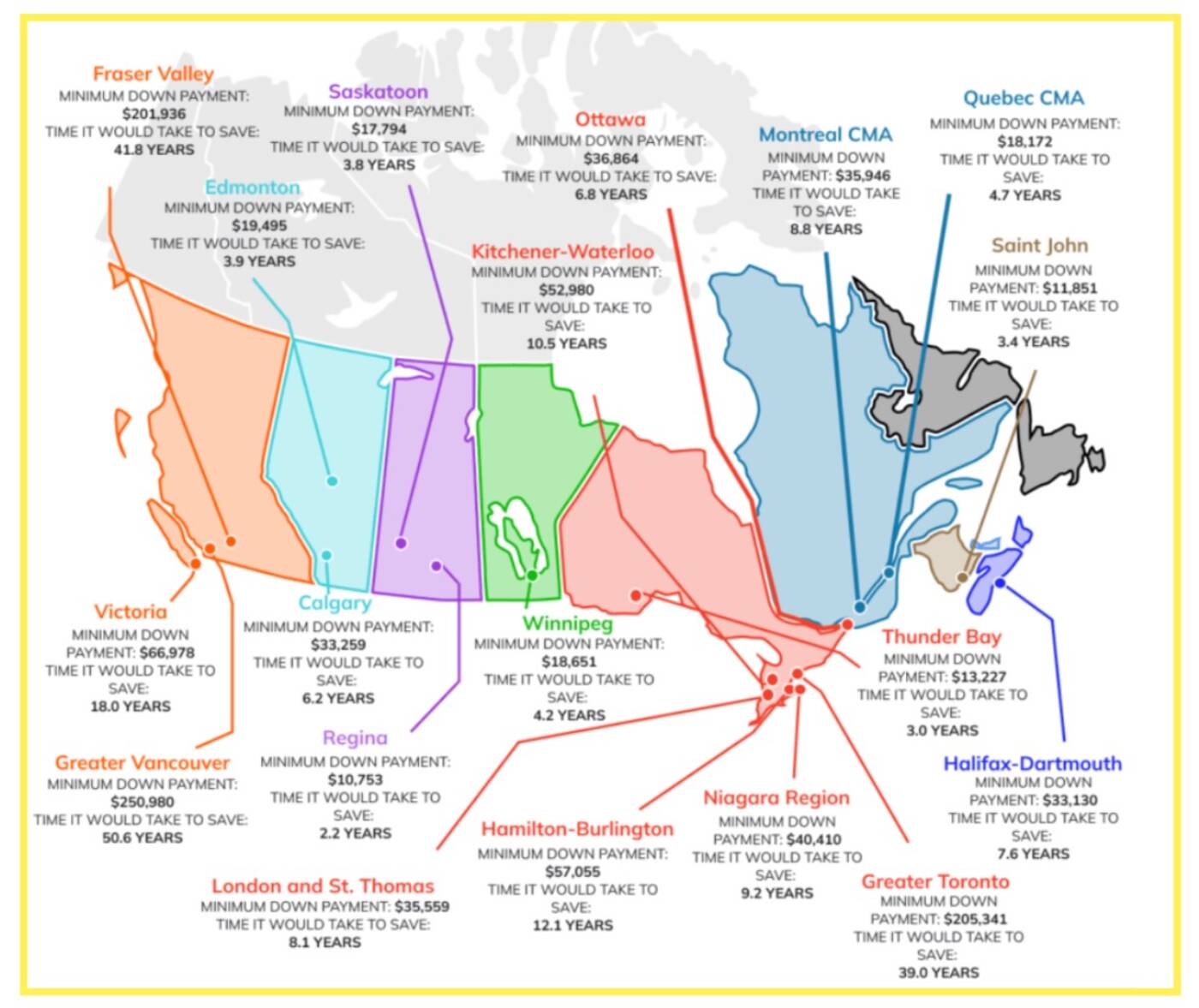

How long it'’ll take you to save for a down payment in major cities across Canada in 2024. Map from Zoocasa.

Of all the markets analyzed, Thunder Bay was found to have the most affordable homes, boasting an average price of just $264,538, meaning that the typical household will be ready to make the minimum down payment in just three years if setting aside six per cent of their salary.

Elsewhere in the province, prospective homebuyers in London and St. Thomas will need to save for just over eight years to make the required down payment of $35,559 with a median household post-tax income of $71,000.

In the Hamilton-Burlington region, the average person will require just over 12 years to save a minimum down payment of $57,055.

How long it'll take you to save for a down payment in major cities across Canada in 2024. Chart from Zoocasa.

"Thankfully, you don’t have to postpone homeownership until these retirement ages, even in provinces with a higher price tag for single-family homes. Residents in B.C. and Ontario should consider a strategic approach to saving for bigger down payments," the report notes.

"To illustrate, exploring opportunities in smaller cities away from bustling downtown cores is a practical approach for those working remotely, where investing in a condo or attached townhome becomes more feasible. Or if you're single, pooling resources to buy a property with a sibling or friend to build equity and save for down payment funds faster."

Royal LePage Connect Realty Brokerage

Latest Videos

Latest Videos

Join the conversation Load comments