This is how much you need to earn to afford a house in Toronto right now

It's no secret that Toronto's housing market and house prices are at the top of mind (and not for positive reasons) for many prospective and aspiring homeowners in the city.

Despite housing prices in Ontario rising less drastically than any other province at the moment, new data from Ratehub.ca still shows that, in order to afford a house in Toronto, you'll have to earn a pretty hefty salary.

According to Ratehub's latest data, in order to afford an average priced home (which, as of February 2024, is $1,093,900), you'll have to make an annual income of $214,100.

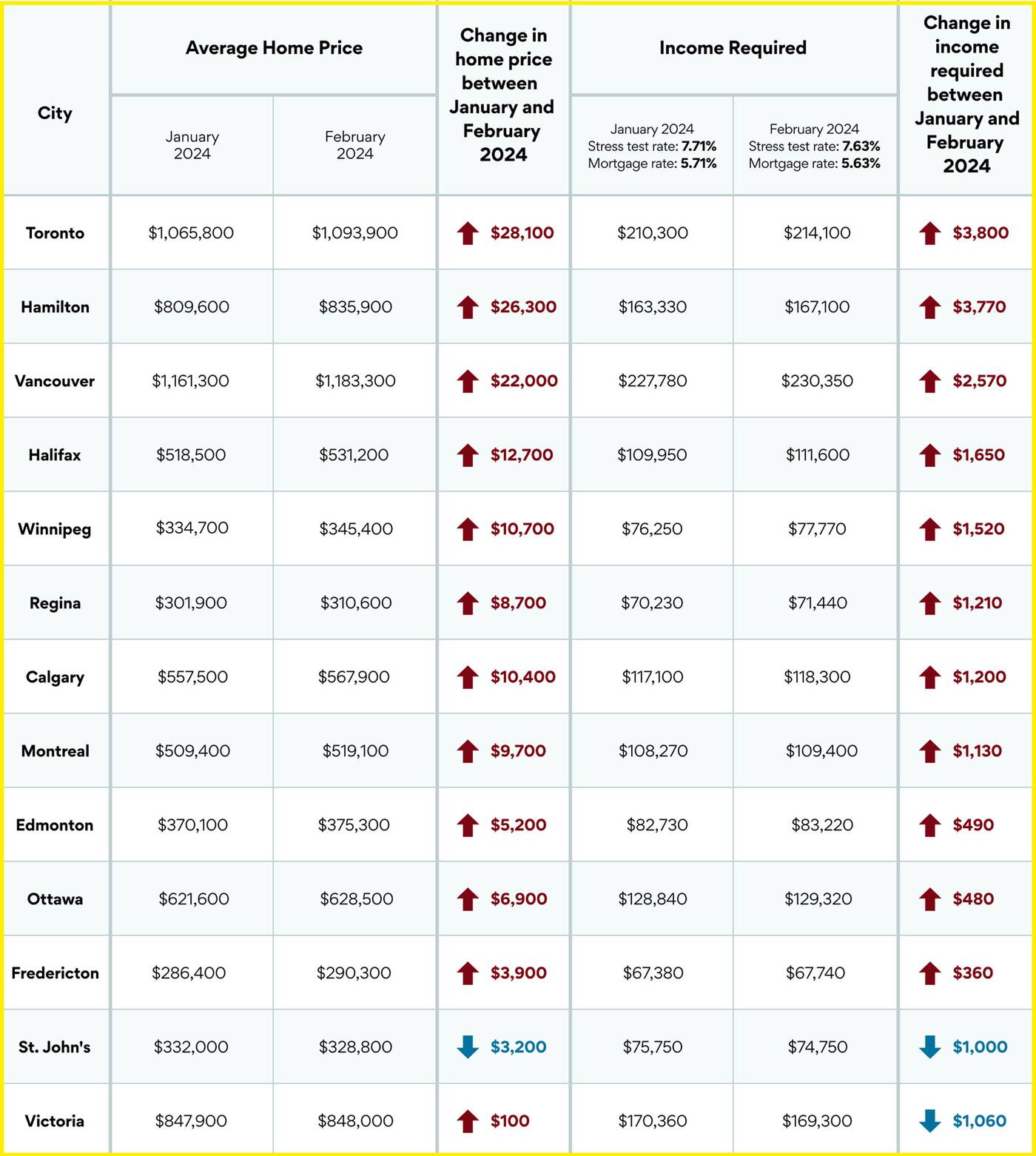

The income needed to afford a home in cities across Canada right now. Chart from Ratehub.ca.

The latest data shows a $28,100 increase in the average home price in Toronto, with $3,800 more per year required to finance one compared to just one month earlier.

The insights also show that, despite a drop in interest rates, 11 out of the 13 cities surveyed saw affordability decrease over the past month, with the outliers being St. John's, where the annual income needed to earn a home dropped by $1,000, and Victoria, where it dropped by $1,600.

Toronto, unsurprisingly, saw the greatest increase, with rapidly-developing Hamilton close behind, seeing a $3,770 increase in the income reqiured to purchase a home.

Looking to buy a house with a less-than-six-figure salary? In Winnipeg, Regina, Edmonton, Fredricton and St. John's, you'll need a minimum income of less than $100,000 to nab the typical property.

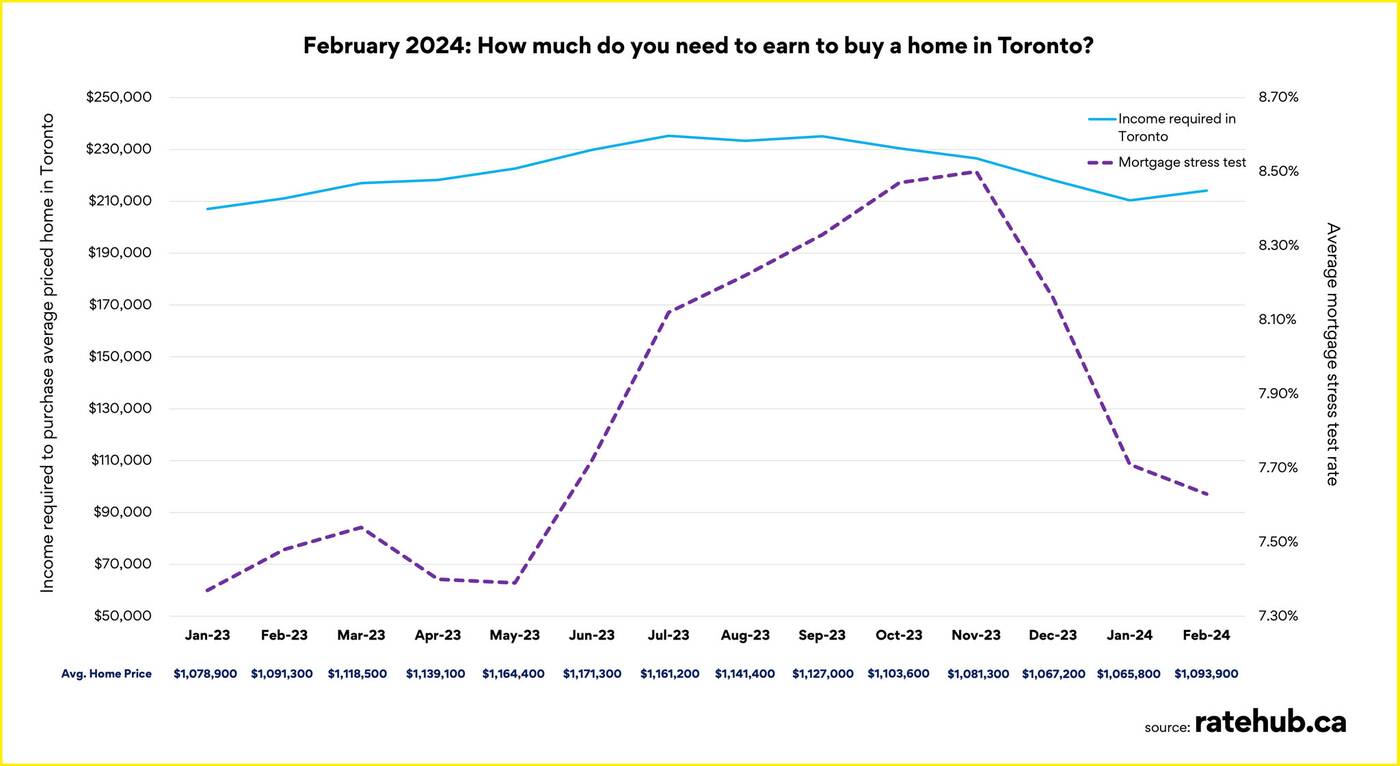

How the income needed to afford the average home in Canada has changed over time. Graph from Ratehub.ca.

While between December 2023 and January 2024, Toronto saw a brief drop in the earnings necessary to go in on a home, it appears to be on the rebound once again.

These figures were calculated based on a standard mortgage with a 20 per cent down payment and 25-year amortization, also factoring in $4,000 a year in property taxes and $150 a month in heating bills.

Fareen Karim

Latest Videos

Latest Videos

Join the conversation Load comments