Here's the income bracket you need to be in to afford a home in Toronto right now

The baseline salary necessary to finance the standard home in Toronto has shot up yet again, with the market's ever-rising prices putting increasingly more pressure on households who are perhaps naively hoping to own a place of their own someday.

The latest figures, which come from Ratehub.ca, show that the annual income required to secure and carry a mortgage at current rates has climbed another $3,400 in just one month thanks to fluctuating prices, hitting $217,500 as of March 2024 (compared to $214,100 in February).

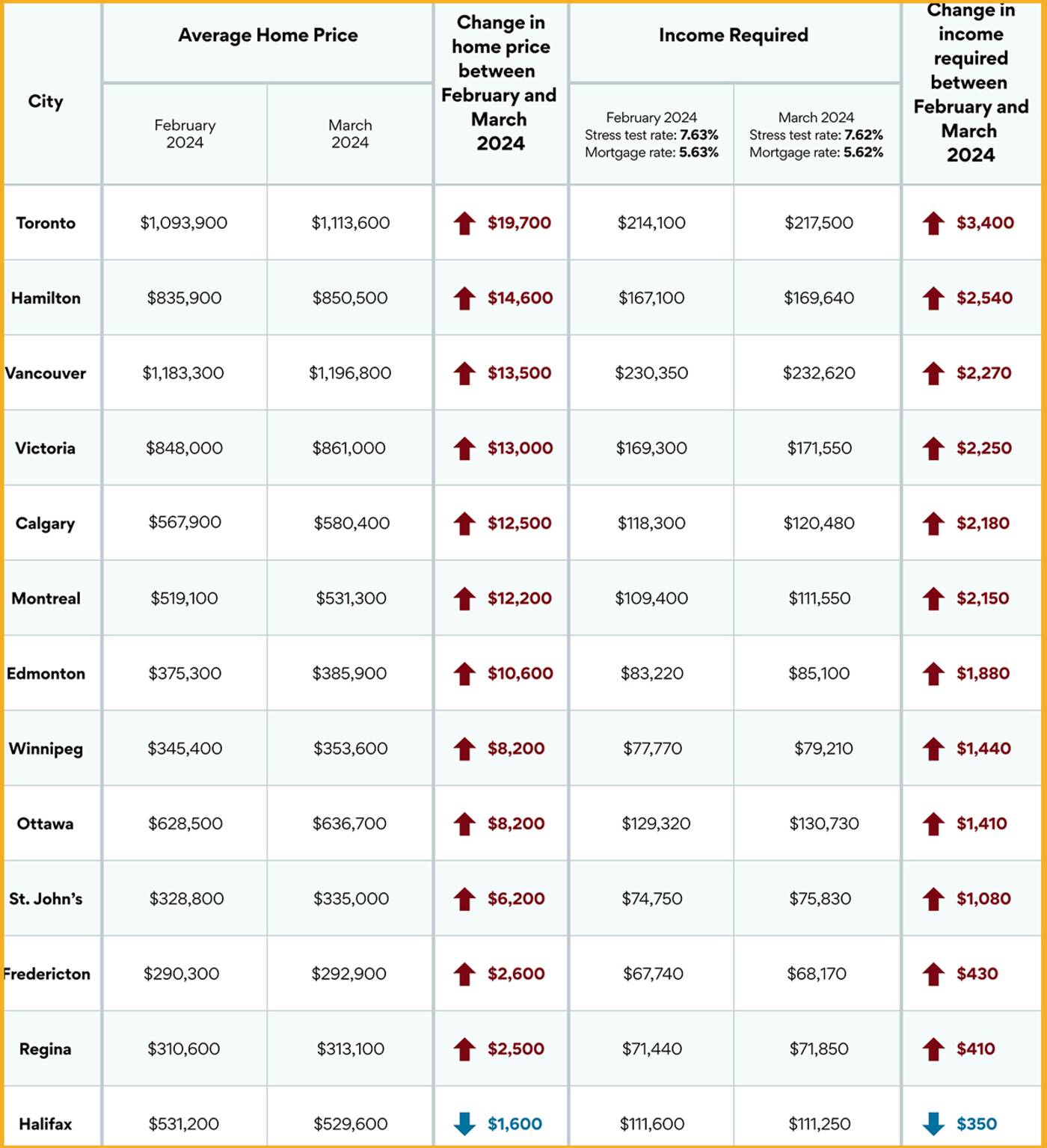

Of course, with the average house or condo now selling for $1,113,600, Toronto saw the largest month-over-month leap in the income needed for a home out of any Canadian city analyzed — even Vancouver, which is the only locale with higher home prices, at an average of $1,196,800 as of last month.

Toronto saw the biggest jump in the income needed to fund a home out of any metropolis examined. Chart from Ratehub.ca.

Speaking of Canada as a whole, Ratehub.ca writes that "While mortgage rates stayed relatively flat month over month, home prices increased, causing affordability to worsen," adding that the minimum salary essential to being able purchase the typical home increased in 12 of the 13 cities examined because of escalating prices from coast to coast.

The one exception on the list was Halifax, where one could earn $350 less per year in March than in February and still be able to afford a run-of-the-mill home, which declined $1,600 in the city during the time span, from $531,200 to $531,200.

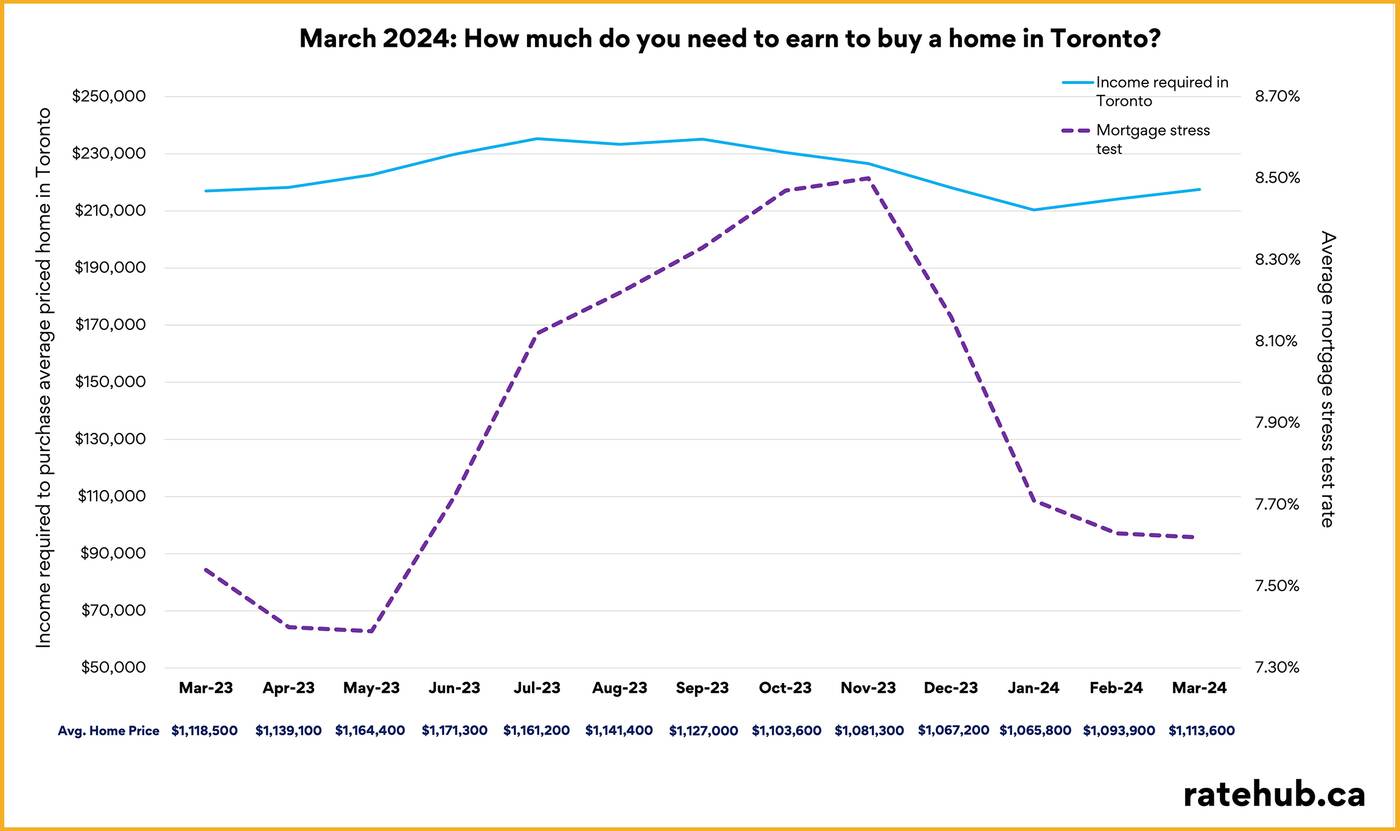

How the salary necessary to afford a home in Toronto has changed over time. Graph from Ratehub.ca.

Those accepting the fact that they will never rake in the big bucks needed to pay for a home in the Toronto area could look to somewhere like Halifax ($111,250 salary required), Edmonton ($85,100), Winnipeg ($79,210), St. John's ($75,830), Regina ($71,850) or Fredericton ($68,170) for cheaper housing prices and less income needed to pay for them.

Sotheby's International Realty Canada/Strata.ca

Latest Videos

Latest Videos

Join the conversation Load comments